A senior banker reviews yet another batch of trade reports late into the night, cross-checking numbers that should’ve been sorted hours ago. The work is slow, the errors are real, and the stakes? Always high.

Sound familiar? For many firms, the daily drag of manual tasks—trade logging, compliance checks, client onboarding—eats away at time and margins.

Here’s what’s shifting fast: A 2024 survey of U.S. bank executives showed that 67% see cybersecurity as the top use case for generative AI. But that’s just the start. From risk flags to trade speed, tech is entering every room of the bank.

The question isn’t “if,” but how. Automation in investment banking is no longer a theory—it’s the fix for the grind that holds firms back. Let’s look at why it matters now.

Automation is transforming investment banking by reducing manual workloads and increasing speed. The rise of generative AI in banking is making operations more efficient and adaptive.

The Case for Automation in Investment Banking

Manual work—trade logs, deal reports, risk checks—is a cost center. It slows the deal flow and eats into analyst time. The old way of doing things doesn’t scale, especially with tighter rules and sharp market swings.

Why automation works is clear:

- It speeds up repeat work and drains resources.

- It cuts out errors that lead to fines or delays.

- It frees bankers to focus on value—clients, deals, and insight.

Will all of the investment banking be automated? No. But routine tasks? Absolutely. The pressure to cut costs is growing. In fact, companies investing deeply in automation saw 22% in cost savings, well above others.

This is not about robots replacing analysts. It’s about smarter work. The kind that lets banks scale without breaking the team. If you’re asking, can investment banking be automated? The answer is—it already is. Just not everywhere yet.

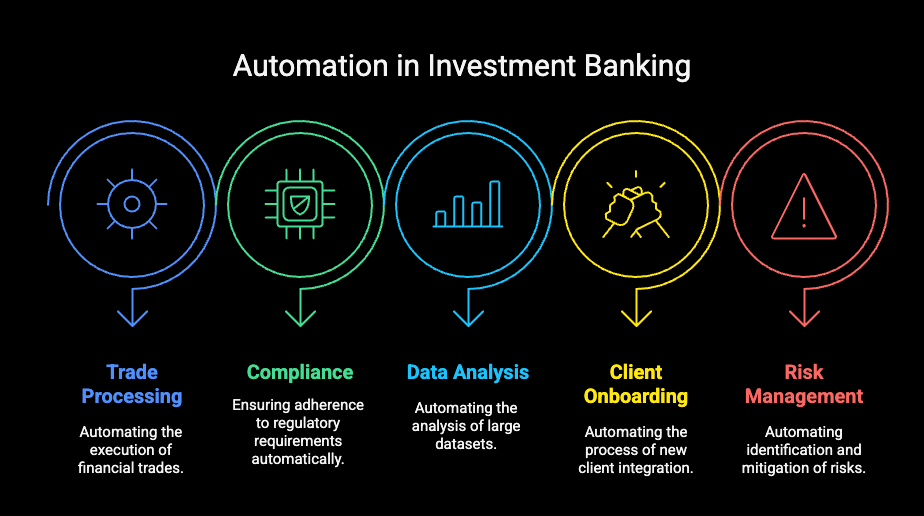

Top 5 Ways Automation Streamlines Investment Banking

1. Trade Processing Automation

What It Fixes: Delays, errors, and manual steps in trade flows.

How It Works: Automation checks trade data, flags mismatches, and completes back-end work with little manual input. It brings speed and consistency.

Examples: In 2024’s fast markets, large banks turned to trade bots to handle volumes that spiked 3x in a day. These tools now auto-process trades in minutes—not hours. Will investment banking be automated? The use of trade bots is a clear step toward automation in the industry.

2. Compliance and Reporting

What It Fixes: Repetitive compliance tasks, late filings, and human errors.

How It Works: Tools monitor new rules, update workflows, and auto-generate reports. With rulebooks getting heavier each year, this is critical.

Examples: Global banks now use automation to file real-time transaction reports across regions. This keeps them ahead of audits and cuts the cost of fines.

3. Data Analysis for Deals

What It Fixes: Slow data crunching, missed patterns, and high analyst workloads.

How It Works: Algorithms pull from multiple data sources—public filings, market trends, private intel—and build profiles fast.

Examples: In live deals, automated tools now support bankers by giving quick snapshots of target firms. This is where investment banking automation boosts speed without skipping insight.

Technology trends in finance are also influencing investment opportunities. The growing success of the best AI companies to invest in reflects how innovation is driving the industry forward.

4. Client Onboarding

What It Fixes: Long paper trails, missed docs, and KYC delays.

How It Works: Smart forms, OCR, and ID checks speed up the process. Banks can onboard new clients in hours, not weeks.

Examples: Large firms now deploy onboarding systems that scan ID docs, check global watchlists, and link accounts with zero back-and-forth emails.

5. Risk Management

What It Fixes: Late red flags, data overload, and poor visibility.

How It Works: AI tools scan trades, client moves, and market shifts to flag early warning signs.

Examples: Risk dashboards now use predictive models to spot exposure trends. With 2025’s unstable economy, this kind of real-time risk tracking is not optional.

One strong real-world example comes from JPMorgan Chase. The bank developed a coding assistant that lifted software engineer output by 10% to 20%. That shift let teams focus on higher-value projects around AI and data—cutting routine work without cutting people. It’s a model that’s quietly becoming standard.

As digital solutions evolve, cloud computing continues to play a vital role in modern banking infrastructure. Many firms are already seeing the benefits of cloud computing in banking in terms of scalability and cost-efficiency.

How to Bring Automation Into Your Banking Game

Pinpoint Pain

Start with what slows you down most. Trade clearing? Report prep? This is where “how to automate investments” begins—by tracking inefficiencies.

Pick Tools

Choose tech that fits the workflow. Don’t bolt on new systems. Match software to the task. LITSLINK has worked with financial teams to build automation that blends into the day-to-day—no noise, just better flow.

Roll It Out

Start small. A test on trade workflows or KYC forms can show clear returns. Once results are in, scale to other units. This is how you prove can investment banking be automated—with real results, not plans.

To fully embrace automation, financial institutions are turning to custom-built solutions. LITSLINK’s financial software development services support banks in building secure, tech-driven platforms.

Final Thoughts

To recap, manual tasks slow things down. Automation speeds them up, cuts risk, and scales teams. From trade logs to risk scans, automation is now key to staying sharp.

Automation in investment banking is not a trend—it’s how modern banks compete. The rise from 33% to 71% in generative AI use in just one year shows the pace of change.

If you’re wondering if investment banking will be automated, the honest answer is no, not fully, but enough to shift the game.

Ready to streamline? LITSLINK’s got the tech to make it happen.