According to McKinsey, banks that fail to modernize risk losing up to 40% of their income to competitors who are digitally savvy by 2027. In a time when success is determined by speed, security, and customer focus, the banking sector needs to reconsider its technological infrastructure or risk going out of the market.

If you’re here, you’re probably dealing with out-of-date legacy systems. These outdated frameworks raise maintenance costs, slow down transactions, and increase security threats. Modernization isn’t just a good idea, it’s necessary to stay up to date and gain the loyalty of customers.

In this article, you will learn how to update banking’s legacy systems with a practical, doable strategy that will be successful in 2025 and beyond. Let’s explore the definition of legacy systems, their increasing drawbacks, and how to modernize them for a real competitive advantage.

What Are Legacy Systems in Banking?

In the banking industry, legacy systems are outdated software or infrastructure that still support essential banking functions, frequently decades after it was initially put in place. These systems manage everything from customer accounts to transaction processing, but they weren’t made for the fast-paced, digital-first world of today.

Why do they cause so much trouble now?

- Slow Transactions: Modern customers are irritated by legacy systems’ inability to process transactions in real-time.

- Security Risks: Cyberattacks and vulnerabilities are common in older technologies.

- High Costs: Keeping up with legacy systems frequently entails paying more for ongoing patches and specialised support.

In today’s race between traditional vs modern banking, outdated systems represent the clunky past. Consumers demand quick, seamless digital experiences, which legacy systems just cannot provide.

We at LITSLINK have personally witnessed how outdated systems slow down banks’ progress and how modernization spurs new expansion.

Why Modernize in 2025? The Digital Stakes Are Higher Than Ever

The stakes for modernizing banking are only going to get higher. Let’s explore the trends that define success in 2025:

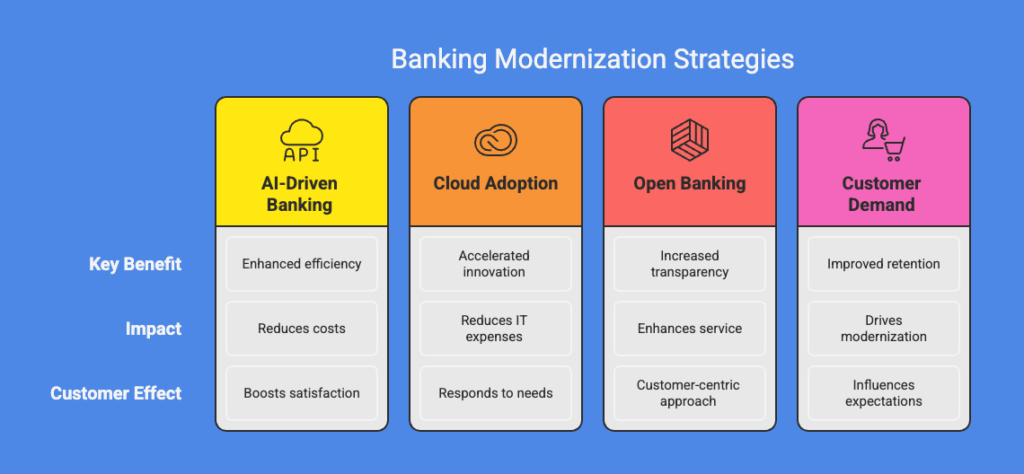

AI-Driven Banking

AI is transforming financial services in a number of ways, including real-time fraud detection and personalized customer recommendations. According to a recent study, banks can save a substantial amount of money on operations and increase customer satisfaction by up to 20% by implementing AI.

Cloud Adoption

Cloud migration significantly lowers IT expenses while accelerating innovation. Research indicates that cloud-native banks are 2-3 times quicker than traditional banks at implementing new features.

Open Banking

APIs are essential to open banking initiatives because they enable banks to securely share data and provide customers with more flexible and connected financial experiences.

Customer Demand

Consumers today have expectations that are influenced by the market and general trends. For better digital services, one-third of consumers say they would change banks. Core banking modernization is no longer optional—it’s the foundation for customer retention and loyalty.

How to Modernize: Your 5-Step Playbook

Legacy system upgrades may seem overwhelming, but they can be handled with a well-thought-out plan. Here is a tried-and-true method:

- Evaluate Your Systems

Map out your existing infrastructure first. Which systems are out of date? Where are the bottlenecks located? Core banking modernization begins with a thorough, truthful evaluation.

- Establish Your Objectives

Is a better user experience for customers, increased security, or quicker transaction times your top priority? Setting clear goals guarantees that your modernization initiatives complement corporate goals.

- Choose an Approach

You have three main options:

- Complete Replacement: Best suited for systems that are beyond repair.

- Refactoring: Updating and improving the current code and structure.

- API Wrapping: Adding new functionality by integrating APIs with legacy systems.

Choosing the right strategy depends on your timeline, budget, and risk tolerance.

- Execute Carefully

To guarantee more seamless transitions, employ cloud-native solutions, integrate contemporary APIs, and migrate systems gradually. To prevent interruptions, always conduct extensive testing before going live.

- Keep an Eye on Trends

Modernization is not a “set it and forget it” proposition. To maintain trust, use sophisticated monitoring tools like Splunk or Datadog to guarantee high uptime and performance.

At LITSLINK, we specialize in guiding banks through seamless transitions, ensuring modernization happens smoothly and successfully.

Choosing the Right Modernization Approach

The journey taken by each bank is unique. Here is a summary of your choices:

- For banks prepared to make significant investments, full replacement creates a brand-new system with a cutting-edge architecture.

- When core structures are still stable, refactoring is the best way to optimize and modify your current systems.

- API wrapping adds new features to outdated systems; it’s quick and inexpensive, but it’s typically a temporary solution.

At LITSLINK, we assist you in selecting the modernization strategy that best suits your goals and available funds, preventing later, expensive rework.

Cost Factors: Budgeting for Banking Modernization in 2025

Setting realistic goals is aided by being aware of the costs up front:

- Depending on the complexity of the system, development costs can range from $100,000 to $5 million (Deloitte, 2024).

- Depending on service usage, cloud hosting costs can range from $1K to $50K per month.

- You should budget between 15% and 25% of your original construction cost each year for modifications and ongoing maintenance costs.

Tips to Save:

- Start by updating high-impact systems (like customer apps or payment platforms).

- To save money on hardware, use scalable cloud services.

- Collaborate with knowledgeable partners such as LITSLINK to steer clear of expensive migration errors.

Investments in modernization are guaranteed to yield the highest returns with careful planning.

Managing Risks During Modernization

There are risks associated with modernization projects, but they can be controlled with the correct approach.

Downtime Risks: Clients anticipate round-the-clock service. Use robust backup solutions and phased rollouts to prevent damaging outages.

Risks of Data Breach: Older systems are easy targets. To protect sensitive data, use multi-factor authentication, encrypt data, and perform routine audits.

User Resistance: Adapting to change can be difficult. To guarantee a seamless transition, educate employees and clients early on, outlining the advantages and offering training.

Conclusion: Modernize Now, Win the Digital Race

2025 belongs to banks that take risks now.

Time, money, and customer trust are all drained by legacy systems. You can compete—and win—by using the digital speed, agility, and security that modern banking offers. Making the correct modernization decision now will benefit you in the future.

Upgrading for the digital age is essential to modern banking success. Consumers won’t wait. The competition will not slow down.

Are you ready to proceed? LITSLINK is an expert at modernizing banking’s legacy systems. Let’s get you started on the path to digital excellence right now.