Becoming a unicorn is the dream of startup founders and represents the milestone at which the value of a company exceeds $1 billion. This achievement signifies that a startup is entering a new phase. At scale, there are more than 1,232 unicorn companies, such as SpaceX, ByteDance (the parent company of TikTok), Revolut, and others.

There is a recognized path that is supposed to lead startups to success and consists of seven phases. However, only a small percentage of founders—less than 10 percent—succeed in following this path, and even fewer achieve unicorn status. Despite these obstacles, many entrepreneurs strive to pass through these stages every year.

Being an entrepreneur involves a lot of risks. And almost all of them are difficult to predict or manage. That’s why it’s not surprising that eight out of ten young companies fail in the first few years of their existence. One of the reasons for this is that you don’t have a clear idea of where you want your startup to go. For this reason, you need to know the phases of a startup to see when the right time is to raise capital so that your startup company does not go under.

This article aims to examine the definition of a startup and showcase 7 key startup development phases.

What is a startup company?

Before considering all the stages a startup business goes through, let’s define what a startup actually is. Different sources provide varying interpretations of what defines a startup business. Let’s focus on two explanations that we find complement each other.

As per Investopedia, a startup is characterized by three aspects:

- It offers a product or service with the aim of capturing a market;

- It lacks funds to progress to the stage of business development prompting founders to explore funding options from various avenues such as venture capitalists;

- There is a probability of failure exceeding 90%.

Another definition suggests that:

A startup is a company founded by an entrepreneur (or a group of them) to meet market demand (sometimes hypothetical) with the help of a product or services they provide under uncertain and volatile conditions.

As a rule, such companies are funded by founders, their families and other investors at different stages of startup development. Let’s have a closer look at them.

7 Main Stages of Startup Development

There’s no exact or universal classification of startup phases. Hence, you may find a lot of scattered information and definitions across various sources and from different entrepreneurs. The reason behind this is that stages of startup development are as volatile as startups themselves, and they can be convoluted and intertwined with one another to a certain degree. That’s why it’s difficult to draw a clear line where one stage finishes and another one starts.

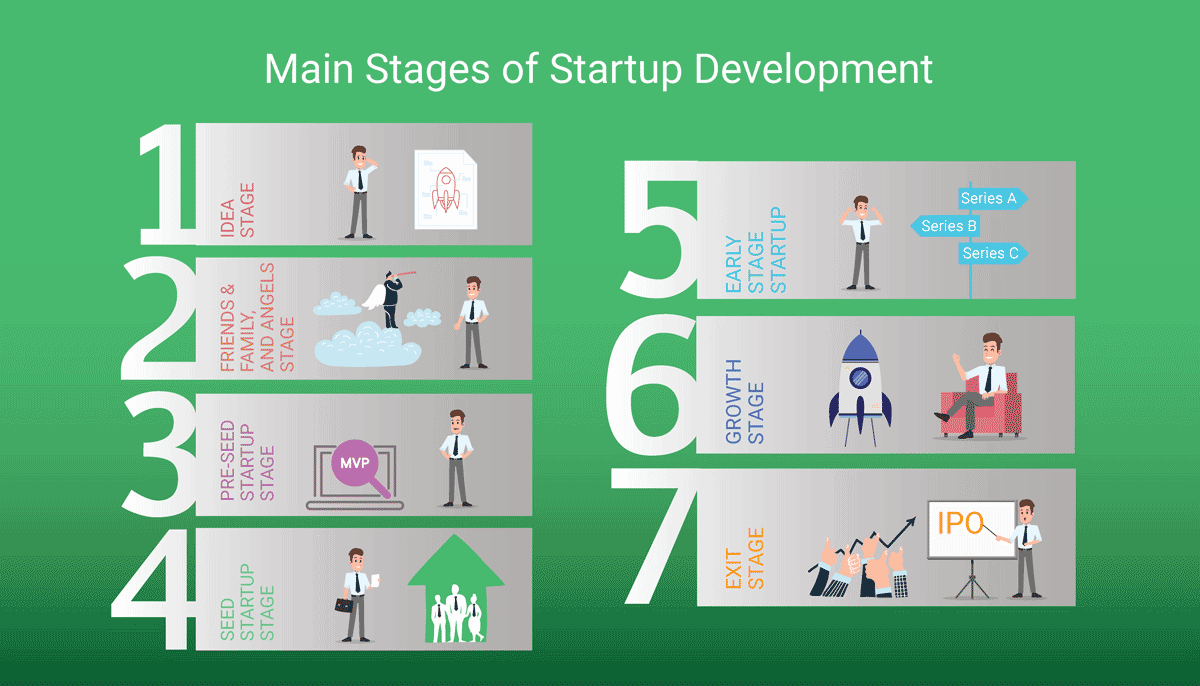

Still, to ease the burden of this unclearness, we try to distinguish seven startup stages based on our experience:

- Friends & Family, and Angels Stage

- Pre-seed Startup Stage

- Seed Startup Stage

- Early Stage Startup

- Growth Stage

- Exit Stage

1. Idea Stage

Every entrepreneurial endeavor starts with a business idea. No matter how you come up with it — during a brainstorm with your friends or colleagues, or you were just hit upon when you least expected it — it’s a cornerstone of every business. But unfortunately, not every “grand design” is neither new nor innovative.

To avoid making a mistake by launching a product or service that nobody needs or wants, make sure that your “million dollar” idea can indeed make a difference. Conduct thorough research to see if your idea is fresh and can bring real value to avoid creating yet another copycat or mediocre product/service. A great idea for your future app that will never be outdated is tech-for-good. Read our blog to learn more.

At the idea stage, you are most likely to use your own means as you’re your own investor here. By bootstrapping and without any external help, you can sustain your startup company and create a business plan, or which is better, to use a Business Model Canvas. It’ll help to “draw” a clear picture of who your customers are, what your unique proposition is, define your cost structure, revenue streams, and many other vital things.

2. Friends & Family, and Angels Stage

Coming up with a worthwhile idea and sustaining it with your resources is only the beginning. You need to expand your startup business and for this, you’ll need more money as your sources are already drying up. This is when the Friends & Family, and also the Angels stage comes to the aid of your startup.

Usually, there are several comparatively reliable ways from where you can attract more investment — through your family and friends and angel investors.

Friends & Family is an investment round when the founder’s kith and kin provide funds for the startup. As a rule, these people are those, with whom the founders already have long-standing and strong relationships. Simultaneously with the Friends & Family round, you can ask angel investors (or just angels) to fund your business. They are a bit different from your friends and family members.

Angel investors or simply angels (also known as private investors) are affluent individuals or a group of them, who have more than $1 million in cash (or assets) and can invest in startups in exchange for the company’s equity. They might be former entrepreneurs who want to invest their money in a promising venture. At this stage, it’s essential to start thinking about forming a business structure, especially when looking for funding from angel investors. Choosing the right structure, such as an LLC, is an essential factor in shielding the assets of investors and your own from litigation. Also, the LLC in the best state matters. The sooner you decide on the appropriate structure, the better prepared you’ll be for growth and securing investments.

As a rule, the Friends & Family, and Angels is an initial stage when the founder wants to bring their product to market but needs outside support. With a business plan in place and new financial support, you can now work on a clickable prototype of your product. It can be a demonstration video (as was the case with Dropbox), or something more interactive that can provide your customer with an idea of what your product will be and how people can benefit from it. Even companies like Airbnb and Uber didn’t achieve their success in a day. Read our blog to explore their business models.

3. Pre-seed Startup Stage

The pre-seed startup is a phase when the entrepreneur requires additional funds to support their startup. For instance, it’s highly important to conduct market validation. From this point of view, this stage is key because it provides answers to your questions:

- Is your product something that your customers really need or want?

- If not, how can you pivot? If yes, are there any essential features it lacks?

To answer all of them, you need to build a minimum viable product also known as MVP which is a proven tool to validate a startup idea. MVP is a representation of your product with the necessary features to satisfy early adopters.

Minimum viable product provides you with an overall understanding of where your startup is heading, what should be changed or added right now, and what works just fine in terms of your product. You can tweak it here and there, to pivot or to drop the idea for good. No matter what the outcome, the pre-seed startup stage helps answer a lot of relevant questions.

4. Seed Startup Stage

The name of the stage speaks for itself. You can imagine a startup to be a seed, which was planted to become a blossoming tree. This stage suggests that you’ve validated your idea. Your product is already generating revenue on a regular basis and your startup is acquiring new customers. But if you want to grow faster, become bigger, and secure your position in the market, you might want to go for the Seed Stage.

Seed-stage startups gravitate towards investment firms rather than individual investors. And business owners can attract investments with the help of these institutions. For example, VCs (or Venture Capitalists) can willingly provide money for startup companies. Moreover, they can provide you with valuable experience, in human resources, and office space, and even guide you through the next development stages of a startup.

In exchange for funding, they will get some share of your company’s equity.

5. Early-stage Startup

Early-stage startups are companies that have already figured out what kind of business model works for them. They generate expected revenue, have customers, and attract new ones, but they need to scale to satisfy an increasing market demand. At this stage, they can begin the funding round series.

The early-stage startup stage includes Series A, Series B, and other series. They serve as important milestones for startups on their way to sweeping success. During this phase, to attract funds, you need to provide investors proof that your startup has already had a steady flow of revenue, customers, and a strong business strategy in place.

During funding series, early-stage startups can rely on the substantial help of investors to reach new heights, satisfy market demand, or even conquer new markets.

6. Growth Stage

At the growth stage, companies bask in the glory of their success. Entrepreneurs have some new options of how to secure the next fund — investors, and bank loans. Banks provide some good advantages, for instance, they can loan you money with low-interest rates, and they don’t require your company’s equity in return.

It’s a milestone after the ups and downs of launching your business. Now that you’ve demonstrated a demand for your product or service, it’s time to focus on expansion.

Typically, this phase occurs after Series A financing has been secured, followed by Series B and C investments. By this point, your company has proven that it is capable of meeting targets and generating revenue. In 2024, the average valuation for Series B startups is $35 million, while for Series C is $50 million.

The process of scaling up can be as turbulent as a rollercoaster ride; however, it is crucial to remain flexible and avoid making decisions. Acting quickly can lead to setbacks. This problem is faced by around 74% of growing startups.

When focusing on growth, remember the importance of improving your product or service to attract a customer base. Expansion also means expanding your team. It will be necessary to hire people with skills that will support the growth of your business.

As a founder, you can no longer do everything on your own. It’s time to entrust others with tasks so that you can concentrate on steering the company in the right direction.

7. Exit Stage

Your company has several offices, maybe even outside of your country. Your product or service has secured its position in the market so strongly that for now, it has become an integral part of your clients’ lives. And now it’s time for an IPO or Initial Public Offering. It’s the final stage of startup development.

IPO is the very first time when a startup (private company) makes its corporate shares available to the public for purchase.

This allows startups to raise funds from public investors and it means that the company’s private status becomes public and its shares become available to an unlimited number of investors. There are several reasons why you might want to consider this option for your startup. Initial public offering helps you attract long-term investment for your business, and boost the company’s prestige, which provides you with high-profile partners and new clients. IPO allows the existing shareholders to sell their shares or you can sell your shares on favourable terms.

Whatever reasons you might have, you can always go for this option.

Wrapping Up

We’ve guided you through the seven startup stages of development. But it should be noted that not all startups should, need, or will follow the same phases. Some young companies end up at the pre-seed stage without moving to the next one, while others sell their company successfully and start a new venture. Each startup might have its own way of development.

But without proper funding, which is the main way how startups survive, you won’t last long in the market. You’ll have to attract investment at least at the initial stages of startup development.

So, if you’re an entrepreneur with a fresh and brilliant business idea in mind and you’re looking to get your startup off the ground, you might need some help — with your prototype, minimum viable product, or pitching to investors. LITSLINK is exactly the company that can help you turn dreams into reality. Our expertise accelerates startups on their way to success through the seven pillars of startup development. Take a look at our outsourcing case studies. We’ve helped a lot of startups make their great ideas come alive, and we can help you build a product that best meets your audiences’ expectations!