Your mobile banking app could be the money machine users trust—secure, fast, and game-changing. Mobile banking app development is your ticket to delivering seamless payments, investments, or enterprise fintech solutions. With mobile banking transactions soaring to $1.68 trillion globally, apps like N26 are leading the charge—your app can dominate too.

We’ll steer you through how to build a mobile banking app, with clear steps, costs, and security insights for a bulletproof launch. LITSLINK’s powered cutting-edge fintech apps—our guide is your fast track to success. Ready to revolutionize banking? Let’s launch your app now.

What Makes a Mobile Banking App? Core Elements

A mobile banking app is a secure, user-friendly platform that empowers users to manage finances—transfers, investments, or bill payments—right from their smartphones. Agile mobile banking software development brings apps like Chime to life, blending functionality with trust to meet the fintech demands.

How do mobile banking apps work? They rely on three core elements to deliver seamless, secure experiences that 69% of users prefer to manage their now banking accounts with mobile phones. LITSLINK’s crafted banking and finance app—we know what drives success in the market.

Core Elements

- Payments: Enable fast ACH transfers, NFC for contactless payments, or crypto transactions, ensuring speed and reliability.

- Security: Biometrics (e.g., Face ID) and encryption protect user data, critical as 60% of breaches target weak apps.

- User Experience (UX): Intuitive dashboards, real-time alerts, and poor navigation make 88% of users less likely to return.

These elements make mobile banking app development a must for competing with fintech leaders. Explore mobile commerce statistics and trends that would be useful since you aim to build an app that would help users to buy things with their mobile phones. Ready to build a trusted app that transforms finance?

Why Build a Mobile Banking App in 2025? The Stakes

A mobile banking app isn’t just a tool—it’s a competitive necessity in a $1.6 trillion mobile banking market. Mobile banking app development lets you deliver secure, seamless financial services, from transfers to wealth management, capturing users who demand instant access.

With 80% of consumers expecting flawless digital banking, apps like Revolut and Chime are setting the standard—your app can lead the charge. Here’s why creating a mobile banking app is a must, driven by cutting-edge trends that boost trust and retention.

Key Trends Driving 2025

- AI Fraud Detection: AI-powered systems cut fishing looses by 90%, with 72% of banks and finance firms adopting them to protect transactions.

- Blockchain Transactions: Decentralized ledgers reduce hacks, ensuring secure crypto or cross-border payments.

- Biometric Security: Face ID and fingerprint scans boost trust, with 58% of users preferring biometrics for logins.

Why It Matters: These trends make mobile banking software development critical to meet user expectations and stay ahead. Build now to deliver a trusted, future-proof app that retains users and drives ROI. Read our blog about the latest mobile app development trends to build an app that stands out.

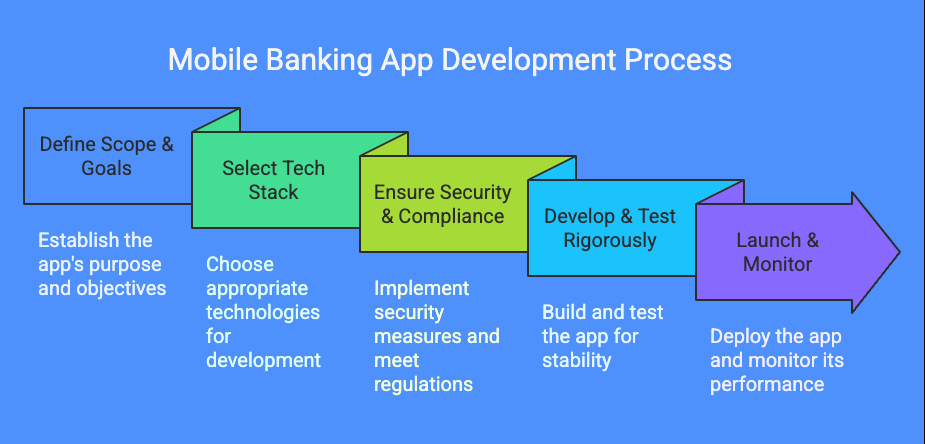

How to Build Your App: 5-Step Secure Roadmap

Launching a mobile banking app demands precision to deliver a secure, user-loved solution. This five-step roadmap ensures your app—whether for payments, investments, or enterprise fintech—meets user needs with ironclad security and seamless UX. Building a mobile banking app requires strategy, and LITSLINK’s streamlined development of mobile banking applications—we deliver secure, market-ready apps. Follow these steps to launch an app that rivals Revolut or Chime.

Step 1: Define Scope & Goals

Start by pinpointing your app’s purpose—fast transfers, wealth management, or crypto trading? Developing a mobile banking application begins with a clear scope, budget, and timeline.

Ask: Who’s the target user? What’s the core feature?

Defining goals early prevents scope creep issues. A precise scope sets your mobile banking app development up for success, aligning the team with your vision.

Step 2: Select Tech Stack

Choose a tech stack to match your app’s needs—Node.js for real-time APIs, Flutter for cross-platform banking app development. Creating a mobile banking app hinges on scalability and speed. For a crypto app, blockchain frameworks like Ethereum ensure secure transactions.

Ask: Does the stack support 10K daily users?

Fintech apps use cloud-native stacks for flexibility. Find out more benefits of cloud computing in our blog.

Step 3: Ensure Security & Compliance

Security is non-negotiable—data breaches mostly target weak fintech apps. Implement biometrics, tokenization, and PCI-DSS or GDPR compliance. For a payment app, Face ID secures logins, while encryption protects transfers.

Ask: Are we PCI-DSS certified? Early compliance saves 20-50% on rework costs. Prioritizing security in mobile banking app development builds user trust and avoids costly breaches.

Step 4: Develop & Test Rigorously

Code APIs for payments and integrate features like real-time alerts, then test for 10K users to ensure stability. Building a mobile banking app demands precision—test NFC payments for a transfer app to ensure flawless transactions.

Ask: Can the app handle peak loads?

Usually post-launch crashes stem from poor testing. Rigorous development and testing ensure your mobile banking software development delivers a reliable app.

Step 5: Launch & Monitor

Deploy on AWS or Azure for scalability and monitor with tools like Datadog for 99.9% uptime. For an investment app, track user spikes during market rallies. Developing a mobile banking application requires ongoing analytics to retain users.

Ask: Are we monitoring fraud in real time? Continuous updates keep your app secure and engaging. A strong launch plan completes your mobile banking app development, ensuring a hit.

Cost Breakdown: Budgeting for 2025

Budgeting for a mobile banking app in 2025 is like securing a vault—you need a precise plan to protect your investment. Mobile banking app development costs range from $50K for a basic transfer app to $500K for a complex wealth management platform, driven by features, security, and compliance needs in the market.

How to build a mobile banking app without overspending? Our breakdown and savings tips ensure your app, like Chime or Revolut, launches securely without breaking the bank—50% of fintech projects face overruns without clear budgets.

Key Costs

- Development: $50K-$500K, depending on complexity—basic apps cost less, AI-driven or blockchain apps more.

- Compliance: $15K-$60K for PCI-DSS, GDPR, or KYC to avoid $150K fines.

- Maintenance: 15-20% of build cost yearly—$7.5K-$100K for updates and 99.9% uptime.

Savings Tips

- Start with an MVP: Focus on core features like transfers to cut mobile banking app development costs.

- Use Cloud Hosting: Platforms like AWS save up to 72% on infrastructure costs.

Clear banking and finance app development budgets prevent costly surprises, ensuring your app delivers trust and ROI in a competitive fintech landscape.

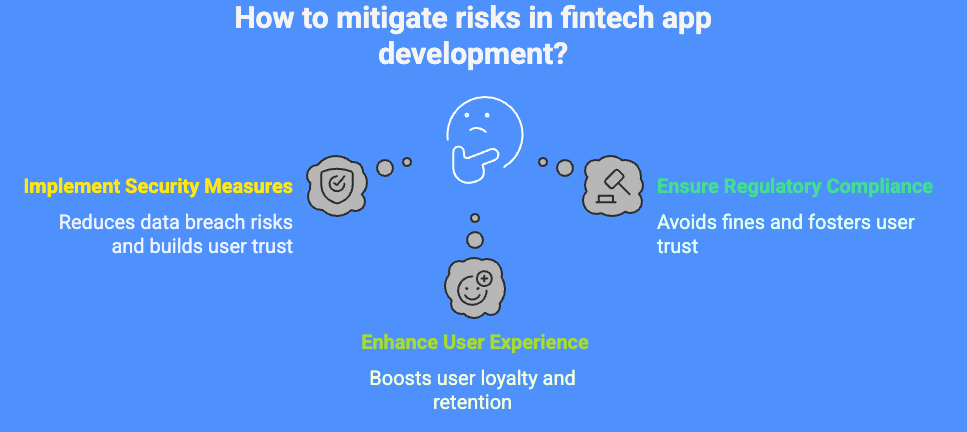

Managing Risks: Secure Your App’s Future

Whether building a payment app or an enterprise fintech platform, these three key risks and solutions will safeguard your launch, keeping your app competitive with Chime or Revolut. LITSLINK’s ensured banking app development with zero leaks—use these strategies to secure your app’s future.

Risk 1: Data Breaches

- Issue: Weak security exposes user data—39% of fintech apps experience breaches.

- Solution: Implement tokenization and regular audits to cut breach risks. For a transfer app, encrypt payment data end-to-end.

- Impact: Builds user trust, preventing user dropouts post-breach.

Risk 2: Regulatory Fines

- Issue: Non-compliance with PCI-DSS or GDPR can lead to $50K penalties.

- Solution: Prep early for KYC and PCI-DSS—early audits save on rework costs. A crypto app needs compliant wallet integration.

- Impact: Avoids fines and ensures regulatory trust.

Risk 3: User Dropout

- Issue: Poor UX drives away 88% of users.

- Solution: Design intuitive dashboards and test checkout flows. A wealth management app needs clear portfolio views to retain users.

- Impact: Boosts loyalty, driving retention.

Mitigating risks in building a mobile banking app ensures your app thrives, delivering secure and trusted banking in 2025’s competitive landscape. Where to find an expert and reliable app development team? Read on the blog to find out.

Conclusion: Launch a Secure Banking App

Mobile banking app development costs $50K-$500K, but our guide equips you to launch a secure, user-loved app. We’ve outlined a 5-step roadmap—defining scope, choosing tech, ensuring compliance, rigorous testing, and monitoring—to avoid breaches and budget overruns. From AI fraud detection to intuitive UX, building a mobile banking app powers fintech giants like Chime—your turn to lead the charge.

Ready to transform banking? LITSLINK’s mastered mobile banking software development—let’s build your secure app to dominatethe market! Hit us up!