A digital wallet app is your vault in the sky—secure, fast, and 2026’s must-have. Digital wallet app development is your key to attracting users in a world where mobile payments are projected to reach $3 trillion globally by 2026. Whether you’re building a simple transfer app or a full-fledged fintech platform, you need a safe, user-loved solution to compete with giants like PayPal.

We’re here to guide you through how to create a digital wallet app, from must-have features to budgeting costs, ensuring a secure edge that keeps customers coming back. LITSLINK has built secure fintech solutions—our e-wallet app development playbook is yours to conquer the digital payment race. Ready to unlock the future of payments with a wallet that wows?

What Makes a Digital Wallet App? The Basics

A digital wallet app is your ticket to seamless payments, storing cards, crypto, or loyalty points for fast, secure transactions. Mobile wallet application development powers apps like Apple Pay, letting users tap to pay or transfer funds in seconds. At its core, eWallet app development delivers three must-haves:

- Payments: NFC for contactless checkouts or QR codes for peer-to-peer transfers.

- Security: Encryption and biometrics (like Face ID) safeguard every transaction.

- User Experience: Intuitive design with easy transfers and rewards integration keeps users hooked. Read about the evolution of mobile app design here.

Why’s it critical? 70-80% of users expect instant, safe payments—anything less, and they’ll ditch your app. E-wallet software development ensures your app meets these demands, blending speed with trust. LITSLINK’s crafted e-wallet mobile apps that shine—we know what works. Ready to build a wallet that wins? eWallet app development is the foundation.

Why Build a Digital Wallet in 2026? The Stakes

In 2026, a digital wallet isn’t just a nice-to-have—it’s a must to stay competitive in a mobile payments market, which hit $1.68 trillion in 2024. Creating a digital wallet app that wins users means tapping into cutting-edge trends that drive trust and retention. Here’s why digital wallet app development is critical for your business to thrive, with consumers demanding seamless, secure payments.

AI-Powered Wallets

- Trend: Artificial intelligence spots fraud and tailors user experiences, like suggesting budget tips based on spending.

- Impact: 40% of fintechs leverage AI to boost security and engagement, keeping users loyal.

Blockchain Security

- Trend: Decentralized ledgers make transactions tamper-proof, cutting hacks.

- Impact: Blockchain in e-wallet app development builds trust, similar to crypto wallets, safeguarding millions.

Biometric Boom

- Trend: Face ID and fingerprints make payments effortless—72% of users prefer biometrics for speed and safety (Mastercard, 2024).

- Impact: Biometrics in mobile wallet application development reduces cart abandonment.

Digital wallet app development isn’t just about payments; it’s about winning customers with secure, seamless experiences. Ready to lead the charge?

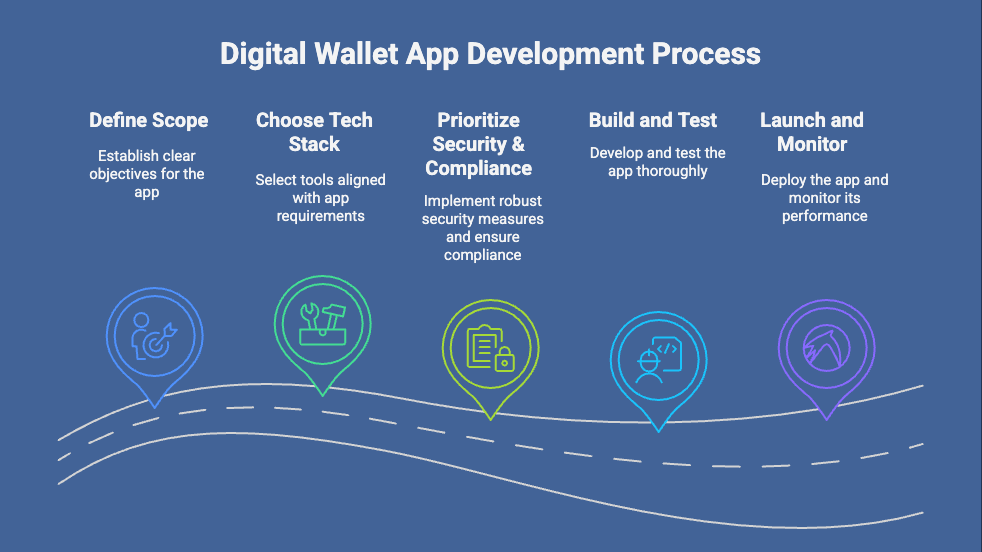

How to Create a Digital Wallet: Your 5-Step Playbook

Building a digital wallet app in 2026 is your chance to tap into over a $1 trillion mobile payments market. Whether it’s a simple transfer app or a crypto powerhouse, digital wallet app development demands a clear plan to deliver secure, user-loved solutions.

This five-step playbook outlines the process for creating a digital wallet app, ensuring your app rivals PayPal or Venmo. LITSLINK has streamlined the creation of an e-wallet app—we’ve built secure solutions that work. Follow these steps to create a wallet that wins in 2026.

Step 1: Define Your Scope

Start with clear goals—simple transfers or a crypto wallet? E-wallet software development hinges on scope. A retail app, for example, needs loyalty integration for rewards alongside payments, while a peer-to-peer app focuses on speed. Ask: Who’s your user? What’s the core function?

Defining scope early prevents 52% of project scope creep. Map features like NFC payments or crypto storage to align with user needs. A well-defined scope ensures your digital wallet app development stays on track and budget, setting the stage for a focused, impactful app.

Step 2: Choose a Tech Stack

Pick tools that match your app’s needs—Node.js for speed, Firebase for low-code simplicity. E-wallet mobile app development thrives on the right stack. For a crypto wallet, blockchain frameworks like Ethereum ensure secure transactions, while a retail app might use AWS for scalability.

Consider team expertise and user load—70% of fintech apps fail without scalable tech. Tools like Flutter speed up cross-platform builds, saving on dev time. Choosing wisely powers your digital wallet app development to handle millions of transactions smoothly. Where to find an excellent app development team? Read our blog.

Step 3: Prioritize Security & Compliance

Security is non-negotiable—60% of breaches target weak apps. Digital wallet app development demands encryption, tokenization, and biometrics like Face ID for a payment app. Compliance with PCI-DSS or GDPR avoids $100K fines.

Use secure APIs and regular audits to lock down data. For example, a transfer app needs KYC verification to meet regulations, a process often streamlined with specialized KYC software. Prioritizing these early ensures your eWallet app development builds trust, keeping users safe and regulators happy in the strict fintech landscape.

Step 4: Build and Test

Code your app with rigor—making a digital wallet app means robust APIs and relentless testing. Build payment APIs for NFC or QR codes, then stress-test for 10K simultaneous users to avoid crashes—70% of users ditch laggy apps.

For an in-store payment app, test NFC reliability across devices. Use tools like Postman for API checks and Docker for consistent builds. Thorough testing ensures your digital wallet app delivers flawless performance, keeping users engaged and transactions secure. Ensure your app aligns with current design trends. Read about 13 key trends in our blog.

Step 5: Launch and Monitor

Deploy on a scalable platform like AWS and monitor with Datadog for 99.9% uptime—critical for trust. Track user spikes during sales, like a retail app handling Black Friday rushes. Set alerts for latency or security threats—proactive fixes retain 80% of users. Regular updates keep your app compliant and fresh. Digital wallet app development doesn’t end at launch—monitoring ensures your e-wallet app stays secure and user-loved in the fast-moving market. Still wondering how to build a mobile app? We’ll explain it in detail in our blog.

Key Features & Their Costs: A Comparison

Choosing the right features for your digital wallet app is like picking ingredients for a winning recipe—get it right, and your app shines; miss the mark, and costs spiral. E-wallet software development hinges on balancing functionality with budget, as fintechs tend to overspend without clear feature plans.

Below is a comparison of four key features—Payments, Security, Loyalty, and AI Analytics—to guide your digital wallet app development budget.

Feature |

Cost Range |

Complexity |

| Payments | $10K-$30K | Simple: NFC, QR codes, or bank APIs for fast transfers. |

| Security | $20K-$50K | Moderate: Encryption, biometrics, and KYC compliance. |

| Loyalty | $15K-$40K | Moderate: Rewards integration, like points or cashback. |

| AI Analytics | $30K-$80K | Complex: Fraud detection, personalized spending insights. |

Picking features for e-wallet app development shapes your budget and user experience. Payments are table stakes for apps like Apple Pay, while AI analytics, though pricier, cut fraud. E-wallet mobile app development thrives on clarity—prioritize what aligns with your goals to avoid overspending and deliver a wallet that wins.

Cost Breakdown: Budgeting for 2026

Budgeting for a digital wallet app is like planning a high-stakes road trip—you need to map every expense to avoid detours. How much it costs to build a fintech app varies—budget wisely to ensure your e-wallet app development delivers a secure, user-loved solution without breaking the bank. With mobile payments hitting $1+ trillion globally, apps like Venmo show what’s possible. Here’s a breakdown of key costs and savvy savings tips for digital wallet app development.

Key Costs

- Development: $30K-$300K, depending on complexity—simple transfer apps cost less, crypto wallets more

- Compliance: $10K-$50K for PCI-DSS, GDPR to avoid fines—critical for 60% of secure apps.

- Maintenance: 15-20% of build cost yearly—$5K-$60K to keep your app updated and secure.

Savings Tips

- Start with an MVP: Focus on core features like payments to cut the cost of developing a fintech app.

- Use Cloud: Platforms like AWS save 20% on hosting costs.

Managing Risks: Keep Your Wallet Safe

Building a digital wallet app means navigating a mobile payments market, but risks like breaches or fines can derail your success. E-wallet mobile app development demands a proactive approach to keep your app secure and users loyal.

Here are three key risks and how to mitigate them to ensure your digital wallet app development delivers a safe, trusted solution like PayPal or Apple Pay.

Risk 1: Security Breaches

- Solution: Use tokenization and regular security audits to cut breach risks. For example, encrypt card data to protect transactions.

- Impact: Keeps user funds safe, preserving trust in your app.

Risk 2: Compliance Fines

- Solution: Early PCI-DSS and GDPR prep avoids $100K penalties. Implement KYC checks from day one.

- Impact: Saves costs and ensures regulatory trust.

Risk 3: User Dropout

- Solution: A smooth UX—fast transfers, clear design—retains 80% of users. Test checkout flows to eliminate friction.

- Impact: Boosts loyalty, driving repeat use.

E-wallet app development thrives on safety—tackle these risks to build a wallet that shines in 2026.

Takeaways

Digital wallet app development costs $30K-$300K, but our guide equips you for 2026 success with a clear playbook—defining scope, choosing tech, prioritizing security, building rigorously, and monitoring for 99.9% uptime. We’ve covered must-have features like payments and AI analytics, budgeting tips to cut costs with MVPs, and risk mitigation to avoid breaches.

A secure e-wallet app development powers apps like Venmo, delighting users in a $1.68 trillion mobile payments market. It’s your turn to shine with a wallet that’s fast, safe, and user-loved. Ready to launch?

LITSLINK’s mastered how to create a digital wallet app—let’s build yours and conquer the digital payments race in 2026! Reach out to us!