Blockchain in insurance has become a game-changing technology in today’s increasingly digital world. Indeed, a McKinsey report claims that blockchain can automate insurance operations and improve fraud detection, resulting in a 30% reduction in operating costs.

Blockchain applications in insurance provide transparency, trust, and tamper-proof data exchange, which are essential in an industry beset by fraud and inefficiencies. These benefits range from expediting claims processing to protecting sensitive customer data. Blockchain is currently being used by insurance companies to enhance operations, boost client confidence, and stop fraud on a large scale.

What is Blockchain in Insurance?

What is blockchain in insurance, and what does it mean? Blockchain is a decentralised ledger system that securely, openly, and irrevocably records transactions. Blockchain technology, when used in the insurance industry, establishes a shared record of data between parties, removing inconsistencies, expediting verification procedures, and significantly lowering administrative expenses.

Simply put, blockchain technology in the insurance sector gives insurers, policyholders, and other parties access to synchronised, real-time data that is impenetrable, ideal for a sector that relies heavily on accuracy and trust.

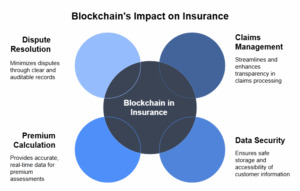

The Impact of Blockchain on the Insurance Industry

Blockchain has a wide-ranging and significant effect on the insurance sector. By automating processes, decreasing human error, and enabling smart contract functionality, it is revolutionising conventional methods:

- Claims management becomes faster and more transparent

- Customer information is safely kept and readily available

- Premium calculations are based on accurate, real-time data

- Disputes are minimized through clear audit trails

The insurance blockchain market is projected to grow at a compound annual growth rate (CAGR) of 85% to reach $1.4 billion in the near future, according to MarketsandMarkets. This rapid expansion is a result of the growing need for enhanced operational efficiency, safe digital procedures, and fraud prevention.

Real-World Applications

Blockchain and insurance go hand in hand, especially in fields that need contractual agreements, secure data sharing, and regulatory compliance. To enhance their service delivery, several international insurers are already making investments in blockchain-based solutions

Important Blockchain Applications in Insurance:

- Smart Contracts: Automatically enforce contract terms, reducing paperwork and delays

- Know Your Customer (KYC): Secure identity verification and onboarding

- Fraud Detection: Cross-verification of claims data across parties to detect anomalies

- Reinsurance: Transparent sharing of data between insurers and reinsurers

- Claim Processing: Real-time status updates and approvals based on predefined conditions

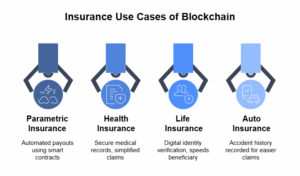

Use Cases

Comprehending blockchain in the context of insurance use cases can aid in visualising its usefulness. Here are a few instances from the actual world:

- Parametric Insurance – Smart contracts are used to trigger automatic payouts based on weather data for agricultural insurance.

- Health Insurance – Blockchain ensures secure storage of medical records, simplifying claim approval and reducing fraud.

- Life Insurance – Digital identity verification via blockchain speeds up beneficiary identification and reduces disputes.

- Auto Insurance – Accident and vehicle history recorded on blockchain for easier claims and underwriting.

These examples all demonstrate how blockchain enhances customer trust, lowers administrative expenses, and increases transparency.

Blockchain Health Insurance: Securing Patient Data

Blockchain health insurance provides a major improvement in interoperability and data privacy. Blockchain unifies and secures sensitive medical data, which is frequently spread across several systems, into a single, impenetrable ledger.

Patients can manage who has access to their data, guaranteeing adherence to privacy laws such as GDPR and HIPAA. In the meantime, insurers have faster access to validated data, which enables them to decide on claims more quickly and accurately.

In addition to enhancing the patient experience, this reduces fraudulent claims, which are one of the main causes of health insurance costs.

It’s also crucial to remember that outsourcing can assist in avoiding hidden costs like infrastructure overhead, training costs, and hiring delays that are frequently connected to in-house development.

Blockchain Life Insurance: Streamlining Verification

Blockchain technology offers a transparent and safe platform for handling beneficiary claims and policyholder data in the context of life insurance.

Blockchain makes it easier to validate claims quickly by providing access to death certificates from reliable sources and verified digital identities. By doing this, disagreements between possible beneficiaries are resolved, and the time to settlement is significantly shortened.

Faster payouts, lower legal costs, and increased policyholder confidence are the outcomes.

Benefit for the Insurance Industry?

Let’s examine how blockchain technology helps the insurance sector in several operational and customer support domains.

Data integrity is one of the biggest benefits. Data is immutable once it is added to the blockchain, which means that it cannot be changed covertly. This guarantees a high degree of openness and trust between all stakeholders.

Automation is yet another significant advantage. Many manual tasks are eliminated by using smart contracts, which lowers labour costs and expedites processing times. Because shared ledgers enable insurers to instantly confirm the accuracy of claims data, avoiding duplicate submissions and highlighting discrepancies, fraud prevention is further improved. Additionally, because every action on the blockchain is automatically time-stamped and recorded, creating a transparent audit trail, regulatory compliance becomes easier. Finally, quicker claims processing and easier policy administration result in increased customer satisfaction and trust in the insurer, which enhances the overall customer experience.

Blockchain in Insurance Market Size and Growth

Over the past few years, the blockchain’s share of the insurance market has grown exponentially. The global market was estimated to be worth $65 million in 2018 and is expected to reach $25 billion by 2030, according to Allied Market Research.

The rise of digital transformation, growing cybersecurity threats, and growing adoption among large insurance companies are driving this growth. Blockchain stands out as a future-proof investment as insurance companies seek to update their infrastructure and satisfy evolving client demands.

Why Blockchain in Insurance Matters for 2025 and Beyond

One of the most significant developments in insurtech is the quick development of the blockchain and insurance intersection. Blockchain provides a scalable, safe, and clever solution for the future as fraud techniques change and data privacy regulations become more stringent.

By implementing blockchain technology now, insurers are setting themselves up for success in the future. They will benefit from stronger compliance, quicker claims cycles, reduced expenses, and increased customer trust.

Ready to Implement Blockchain for Insurance?

LITSLINK is the partner you need if you’re thinking about using blockchain for insurance, regardless of your goals—fraud detection, protecting private policyholder information, expediting the claims process, or improving regulatory compliance. Our skilled group of blockchain developers and solution architects has a wealth of experience creating high-performance, scalable, and secure systems that are suited to the particular needs and goals of insurance companies.

With a strong grasp of the insurtech space and a track record of success across industries, we provide more than just code—we provide tangible, quantifiable value. LITSLINK offers a full-service partnership that grows with your company, from strategy and development to launch and continuing support.

Fortunately, we have extensive blockchain development experience. We can also do that for you. Let’s begin by getting in touch with us!