In today’s digital reality, cloud computing in banking plays a vital role in business operations. Therefore, ensuring cloud application security is paramount for safeguarding sensitive information from cyber threats like data breaches, unauthorized access, and malicious attacks.

Playing with real money offers an unbeatable thrill that virtual currency can’t match. Some big banks like Bank of America, BBVA, and Barclays are already using cloud computing, while most other banks are working on expanding their use of cloud computing. The cloud helps banks work better and faster and allows them to store data safely. For customers, the cloud provides better customer service by enabling them to check their accounts and do online banking.

Why is Cloud App Security Necessary?

Cloud apps have become essential as financial services cloud computing has become integral in modern businesses. They keep personal info, account records, and sensitive work files in the cloud. So, maintaining cloud app safety is a must.

Safeguarding digital assets is a must due to evolving cyber risks and the growing reliance on cloud technology for business operations.

- Keeping data secure is paramount when cloud apps handle private, confidential, or personal details. Robust encryption and access controls prevent unauthorized access and data breaches, shielding information from external threats and internal vulnerabilities.

- Many sectors face strict regulatory mandates for data storage security and privacy. Cloud app security ensures adherence to laws like GDPR, HIPAA, and others, helping organizations avoid legal penalties, disruptions, and reputational harm.

- Cloud computing in banking and financial services can be accessed from anywhere, raising security breach risks, especially from unsecured networks or devices. Implementing strong protective measures ensures data remains safeguarded regardless of access location or method.

- In cloud computing, both the service provider and client share security responsibilities. Clients secure apps and data, even if the provider manages infrastructure. This shared model necessitates understanding security protocols to effectively protect applications.

- Advanced cybersecurity solutions for cloud apps in financial services include threat detection and response capabilities. Identifying and mitigating threats in real-time is crucial for preventing potential damage and reducing attackers’ opportunities.

- Business operations must continue seamlessly, even in the face of cyber threats. Robust security measures in cloud applications ensure services remain functional. This uninterrupted continuity is vital for preserving customer trust and avoiding financial setbacks caused by downtime or data breaches.

- Embracing innovation safely is key. As different businesses explore cutting-edge banking cloud computing technologies and use artificial intelligence, securing these applications allows them to integrate new tools without compromising security. This protection supports growth strategies while mitigating risks in the business process.

The security provided by cloud computing in the banking industry is not merely a precaution; it is a fundamental component of modern IT infrastructure. It upholds operational integrity and legal compliance and enables strategic growth.

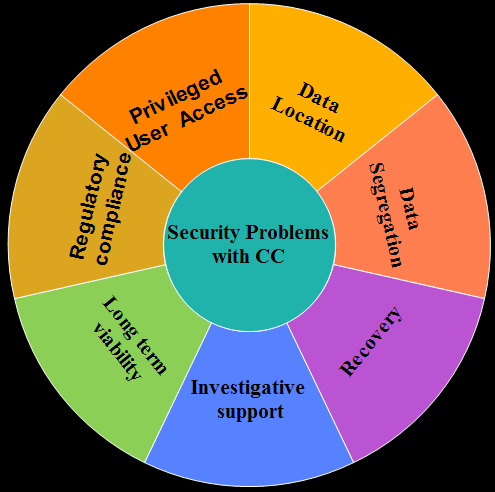

What are the Cloud Application Security Issues?

For companies that use cloud computing in financial services, strong safety rules are very important because cyber threats keep growing and more apps are using the cloud.

Cloud app weaknesses and threats can harm data safety, access, and privacy. A big issue is data breaches, where secret info gets to bad people due to poor safeguards against advanced cyber-attacks. Wrong cloud settings often let data be seen or let people in who shouldn’t, as clouds are tricky to secure without know-how.

The shared duty model complicates things, with security jobs split between provider and user, leading to mix-ups over duties.

Keeping data and apps safe in the cloud is crucial, and due to its changing nature, it becomes easier with cloud computing. Standard safety steps may not work. Constant updates pose risks needing watchful oversight, and inside threats, such as large data, should not be accessible without proper controls.

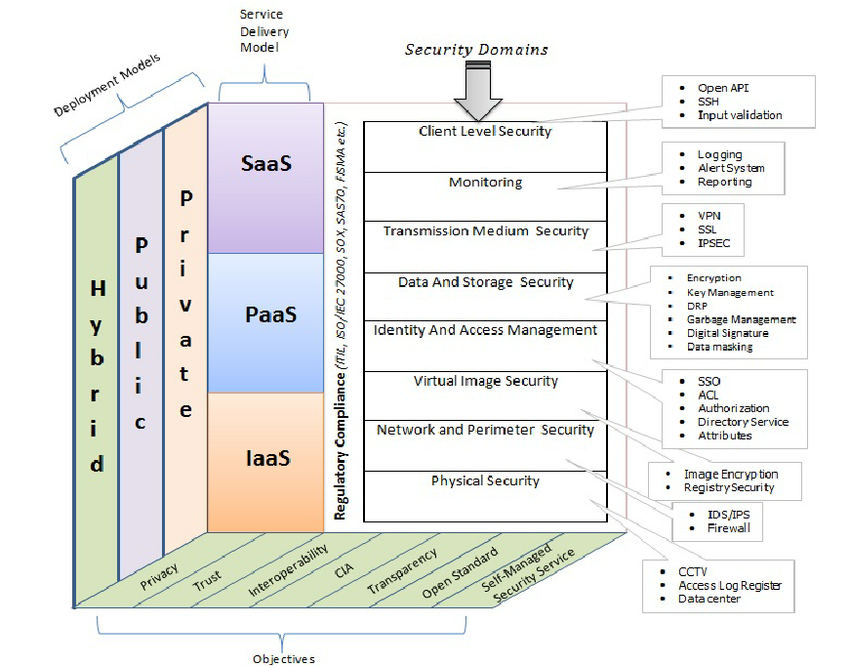

Cloud Application Security Framework

The Cloud Application Security Framework comprises several critical components designed to enhance the security of financial cloud computing. Among these components are Cloud Security Posture Management (CSPM), Cloud Workload Protection Platform (CWPP), and Cloud Access Security Broker (CASB). Each plays a unique role in securing cloud applications and data, addressing specific aspects of cloud security challenges.

Cloud Access Security Broker (CASB) acts as an intermediary between users and cloud service providers, enforcing security policies at the access control level. CASBs provide visibility into enterprise cloud use, assess security risks, enforce security policies, and comply with regulations. They help control access, protect sensitive data, prevent data leakage, and secure against threats by extending the security controls of the on-premises infrastructure as a service to the cloud.

Cloud Workload Protection Platform (CWPP) is designed to secure workloads that run in the cloud environment, including virtual machines, containers, and serverless functions. CWPP solutions provide runtime protection and monitor workloads to detect and prevent threats, unauthorized changes, and malicious activities.

Cloud Security Posture Management (CSPM) focuses on identifying and remediating risks associated with cloud configurations. As organizations deploy and scale their cloud environments, managing the cybersecurity posture becomes crucial. CSPM tools automate the detection of misconfigurations and compliance risks, helping organizations maintain secure cloud configurations across multiple platforms. They provide continuous monitoring and assessment to ensure that cloud computing in banking adheres to security best practices and regulatory standards.

Together, these components of the Cloud Application Security Framework provide a comprehensive approach to securing cloud applications and providing high-level cloud computing financial services. They help organizations protect their cloud assets from evolving security threats while ensuring compliance with internal and external regulations. This framework is essential for managing the complex cybersecurity requirements of modern cloud environments, enabling secure cloud adoption and operation in a scalable and efficient manner.

Scalable Cloud Application Security Architecture

Scalable cloud application security architecture is critical in ensuring that as businesses expand, their data integrity and network infrastructure remain protected against evolving cyber threats.

- Continuous monitoring and real-time analytics. Scalable security architectures require constant monitoring to detect and respond to threats in real time. Implementing advanced security information and event management (SIEM) systems can provide ongoing insights into security status and alert administrators to potential vulnerabilities or breaches.

- Multi-tiered security model. A scalable architecture often begins with a multi-tiered security model that applies specific defenses at different layers of the cloud stack. This includes physical security at the data center, network security to protect data in transit, and application security to safeguard against threats at the software level.

- Identity and Access Management (IAM).

- Automation and orchestration. As the scale of cloud environments increases, manual monitoring and management of security become impractical.

- Data protection and encryption. As data scales, maintaining its security becomes more complex; nevertheless, it’s a must. Scalable architectures must include robust encryption protocols for data at rest and in transit. Companies appreciate this as one of the main benefits of using cloud computing.

- Adaptability to regulatory changes. Scalable architectures must also consider compliance with various regulatory requirements, which may change as businesses enter new markets or as legislation evolves.

- Cloud-native security features. Leveraging built-in security features offered by cloud service providers can enhance scalability.

By addressing these elements, a scalable cloud application security architecture ensures that organizations can grow and adapt to new challenges without exposing themselves to increased cyber risk. Cloud computing for banks protects valuable data and systems and supports dynamic business requirements in an ever-evolving digital landscape.

Cloud Application Security Best Practices

Securing cloud apps is essential to protect information and keep business tasks safe in the cloud. The best options to secure cloud apps use strict rules, advanced tools, and proactive steps.

- Use zero trust security. Zero trust means nobody is trusted from inside or outside the network, and everyone trying to access things must verify who they are. This helps secure cloud apps.

- Encrypt data. Encryption should always be used for all data, whether stored or moving. This keeps sensitive info safe from unauthorized access and potential data breaches.

- Control access carefully. Access to cloud apps should be managed through strong identity and access management systems. Using multi-factor authentication, strict password rules, and limiting access to only what’s needed can greatly reduce unauthorized access risk.

- Update and patch regularly. Hackers often exploit software vulnerabilities. Regularly updating and patching cloud apps and infrastructure, as well as software development, helps prevent this risk.

- Monitor continuously. Real-time monitoring and logging activities can quickly detect and respond to threats. Using automated tools to analyze logs for unusual activity can stop potential breaches.

- Train staff well. Human error is a big security risk. Regular training for employees on security awareness, phishing prevention, and safe practices is essential.

Following good rules will help create a safe cloud environment. Your cloud environment will be safe, and you can move quickly in business transformation. The list of banks using cloud computing proves the effectiveness of this service.

Best Cloud Application Security Solutions

Picking the top cloud computing in financial services ensures that data, apps, and cloud tech are secured. They must not only be kept safe but must evolve as new risks and new tech arise.

- Cloud Access Security Brokers (CASBs) are key for making safety rules work outside the financial institution. CASBs let you see how people use cloud apps, keep data safe across many finance cloud computing platforms, and control who can use cloud services.

- Cloud Security Posture Management (CSPM) tools find and fix risks with cloud setups. These tools help companies follow the best safety rules and must-dos by catching bad setups and risks in cloud places.

- Cloud Workload Protection Platforms (CWPPs) keep workloads safe across different locations like virtual machines, containers, and serverless uses. They stop threats, make sure rules are followed, and manage safety setups for changing cloud workloads.

- Identity and Access Management (IAM) solutions are critical. They make sure only the right people gain access. Things like multi-factor authentication (MFA), single sign-on (SSO), and watching how users act boost safety.

A comprehensive plan and the right tools for cloud computing in the banking sector will keep cloud apps and data safe from bad guys inside and outside. This gives peace of mind and helps businesses keep going.

Conclusion

Effective application of cloud computing in the finance industry involves multiple protective layers, including data encryption, access control, secure software development practices, and regular security assessments. Cloud computing for financial services is the measure that helps to mitigate risks associated with cloud computing, such as data loss, leakage, and account hijacking.

In conclusion, cloud computing in finance is complicated but very much needed for firms to do well in the fast computer world. Many big companies like JPMorgan Chase and HSBC have put money into cloud computing, proving that they care about user data and better customer service. If you want to use new digital tools, contact our experts for a consultation. They will help you boost your business.