Why do so many businesses still lose time jumping between disconnected finance tools, slow systems, and outdated reports? And why do some fintech startups move faster than traditional banks? That’s the gap the right fintech stack fills. In Q1 2024, global fintech investment reached $7.3 billion across 904 deals. Even in uncertain markets, investors are betting on this space. Why? Because the right finance tech stack cuts costs, improves accuracy, and moves with your business, not against it.

This guide shows how a strong fintech technology stack helps you reduce friction across payments, analytics, compliance, and more. It also breaks down what tools actually matter, how to pick them, and what mistakes to avoid.

If your team is still juggling spreadsheets and manual approvals, you’re behind. Let’s fix that.

What Is a Fintech Stack?

A Fintech Stack is a group of software tools and platforms that help financial services or tech-based companies run their operations. These tools manage everything from payment processing and lending to compliance and fraud detection.

The stack may include frontend interfaces, backend systems, data security, APIs, and reporting platforms. It’s not one system. It’s a full system of connected parts.

Why Every Business Needs a Fintech Tech Stack

A good fintech tech stack benefits any company that touches finance, even if it’s not a fintech startup. From faster transaction handling to better reporting, building a stack with content to ensures better visibility and alignment with how users search for modern financial solutions.

Fintech companies are expected to grow revenue by 15% per year until 2028, while traditional banks sit around 6%. That’s because fintech tools scale faster, cost less to maintain, and automate more work.

- Reduces manual data entry and human errors

- Improves fraud detection with real-time alerts

- Lowers customer onboarding time

- Makes reporting faster and more accurate

- Increases payment processing speed

Key Components of a Complete Fintech Technology Stack

A solid fintech technology stack has tools for every core business function, from user interface to compliance. Each part connects with others and handles a unique job. Picking the right parts depends on your business type, size, and scale goals.

1. Payment Infrastructure

Payments are at the center of every fintech product. Whether it’s an e-wallet, lending platform, or neo-bank, the system needs tools to send, receive, and store money.

This layer usually includes payment gateways, acquiring banks, fraud filters, and settlement systems. These tools must handle multiple currencies, card types, ACH, and blockchain if needed. APIs are a must here to link systems in real-time.

A good tech stack for fintech ensures payment actions happen with low latency and high security. Even a few seconds delay can frustrate users and affect trust.

2. Core Banking and Ledger Systems

This is where account balances, transaction logs, and financial rules live. It’s the engine behind any fintech app. Core banking tools manage things like account creation, credit scoring, deposits, loan rules, and internal transfers.

Ledger systems track every money movement, down to the cent. These systems must be auditable, fast, and scalable. Traditional core banking systems were hard to modify. Today’s banking tech stack offers modular options for faster updates and integration.

3. Customer Experience Tools

Every user touches this part. Mobile apps, custom fintech websites, customer portals, support tickets, and onboarding flows must be easy and secure. A poor UI hurts growth. That’s why UX tools, authentication tools, chatbots, and document upload systems are included in the wealth management tech stack or any client-facing fintech product.

These tools affect customer trust. The best stacks reduce clicks, improve clarity, and help users fix problems themselves.

Read our article on Fintech App Development Cost to learn more about receiving realistic estimates for fintech app development, price recommendations, and cost-effective app launch strategies.

How to Choose the Best Tech Stack for Fintech Businesses

There is no one-size-fits-all best tech stack for fintech. The right stack depends on your customers, risk level, growth targets, and team resources. Pick tools based on actual needs, not trends.

- Focus on what your users need most.

- Make security the default, not an add-on.

- Choose tools with open APIs.

- Look for cloud-ready, scalable infrastructure.

- Avoid systems that trap your data.

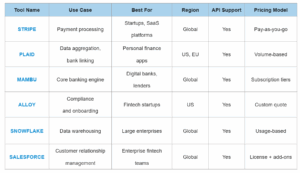

Best Fintech Stack Tools for Startups, Banks & Enterprises

Different businesses need different fintech tech stack tools. Startups often need speed and simplicity. Banks focus on regulation and data control. Enterprises want scale and stability. But all need reliability, flexibility, and low maintenance.

Here are some of the most used global tools in each category. Each one fits a different part of the finance tech stack, from payments to data to compliance.

Challenges of Managing a Fintech Tech Stack

Even the best tools don’t work well if they’re disconnected or poorly managed. A good fintech technology stack also needs ongoing review, updates, and clear ownership.

Here are the biggest problems businesses face when managing their tech stack for fintech operations:

- Too many disconnected tools.

- High maintenance costs.

- Poor API documentation from vendors.

- Version mismatches across services.

- Weak monitoring or logging systems.

- Security issues from outdated modules.

- Difficulty integrating new features.

Every finance company, startup or bank, needs a plan for tool upgrades, data backups, and vendor checks. Otherwise, tools turn into tech debt.

Read our article on AI in Fintech to learn more about how fintech AI is transforming the fintech landscape, enhancing lending processes, wealth management strategies, and more.

Choosing Between Off-the-Shelf and Custom Fintech Stack Solutions

One of the biggest decisions you’ll face is whether to use ready-made tools or build your own system. Both have benefits, and trade-offs.

Here’s how to think about it:

- Need to launch fast? Off-the-shelf helps.

- Have unique backend or security needs? Go custom.

- Need to change features often? Custom helps you adapt.

- Want faster regulatory approvals? Use proven third-party tools.

- Managing high volume or sensitive data? A hybrid approach might be best.

Most modern fintechs start with ready-made systems, then slowly replace core parts with custom code as they scale. That’s how they stay fast without giving up long-term control.

Read our article on 5 Best Finance AI Chatbots to learn more about their pros, cons, and features.

Build a Scalable and Secure Finance Tech Stack

Your finance tech stack should grow with your business, not slow it down. Whether you’re building a digital wallet, a trading app, or a lending platform, your tools must support your users, your regulators, and your team. Incorporating finance AI tools can further streamline operations and enhance decision-making.

LITSLINK is the partner to implement your own digital financial instruments. We help you build the right tech at the right speed, with the right compliance in place.

Talk to a team that understands finance, code, and your market.