The right budget can launch a unicorn. The wrong one can kill your fintech dream.

You’re prepared to release a financial app, such as a personal finance manager, trading tool, or payment platform. However, before any code is written, a crucial question remains: How much does it cost to build a fintech app?

FinTech’s cutting-edge technology and lower costs give it a distinct advantage over traditional financial services. It is more accessible through digital wallets, automated investment management, online banking, and cryptocurrency trading.

By 2030, the FinTech market is expected to grow to a value of $700 billion. With years of experience, LITSLINK prioritizes compliance, security, and user experience requirements while assisting Fintech startups and SMEs in designing, developing, and launching innovative solutions.

In this article, we’ll go over the cost of developing a fintech app, outline the contributing factors, and offer practical cost-cutting strategies. This is the roadmap you need if you’re serious about launching a profitable financial product.

What Drives Fintech App Costs? The Big Picture

An extremely competitive environment has been created recently by the global explosion of fintech startups, with North America and the EMEA leading the way. Building an app that not only stands out but also satisfies a specific need is crucial in this environment. This is frequently more expensive.

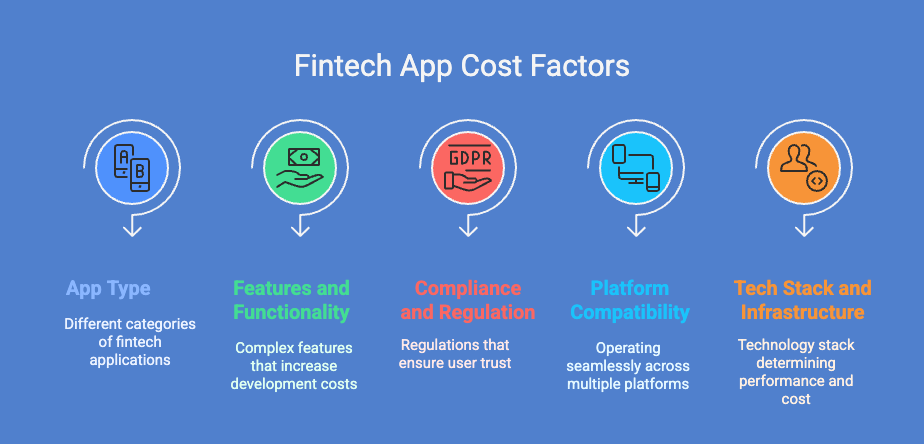

Since developing a fintech app is a complex process with costs based on numerous variables, it is essential to comprehend the cost of app development. Accurate budget estimation requires an understanding of these factors.

The quality of the application should never be sacrificed amid all the cost optimization and number crunching. A well-designed fintech app has the potential to revolutionize a particular market. It provides customers with smooth services and challenges established players in the financial market.

Many factors, including extensive testing, custom UI/UX design, and the implementation of multiple payment integrations, also play a role in development costs, in addition to the need to establish a niche market and increased competition.

Knowing what goes into your fintech development app’s cost estimation is more important than speculating. Let’s explore the major factors influencing costs in 2025.

1. App Type

FinTech applications fall into several general categories, each with unique features, functionalities, and development expenses. The first and most important cost factor is the type of app you’re developing. This is the reason:

- Budgeting apps like Mint are relatively simple and lower-cost.

- Payment apps like Venmo require secure transfers, real-time updates, and compliance.

- Trading apps like Robinhood include complex data feeds, AI, and charts.

- Enterprise fintech platforms for banks or insurers demand multi-user access, integrations, and high-level security.

The cost to build a fintech app is influenced by each of these use cases. The final price grows with the number of features of your app. These are approximations that may change based on the technology, development team, and app complexity. They do, however, give a broad notion of the development expenses related to each kind of fintech app.

2. Features and Functionality

Complex features like real-time analytics, payment gateway integration, security protocols, and more are frequently included in fintech apps. Development costs will unavoidably increase with more sophisticated features. Because delivery time has a significant influence on the whole cost of building a financial application, time management is critical in the creation of fintech mobile apps.

The final budget expands with the number of features you integrate. Take a look at these powerful ones:

- Real-time market data

- AI-powered insights

- Blockchain integrations

- Peer-to-peer payments

- Budget tracking and forecasting

- Biometric authentication

A platform with a ton of analytics and machine learning will cost much more than a lightweight MVP with a simple dashboard, login, and transfers.

3. Compliance and Regulation

A complicated network of rules dictates how the financial industry operates. Maintaining compliance is essential to avoiding severe fines and preserving user confidence.

Whether it’s banking standards, anti-money laundering laws, sanctions, or data privacy laws, compliance entails paying for legal advice, audits, and the installation of required security measures.

Security and compliance are essential components of fintech, not optional extras. You need to fulfil requirements such as:

- GDPR (for user data privacy)

- PCI-DSS (for secure payments)

- KYC/AML (Know Your Customer and Anti-Money Laundering)

At least 15% of your development budget may be consumed by these regulations. Cutting corners now could result in much higher fines or rework down the road.

4. Platform Compatibility

Creating a fintech app that works on several platforms, like iOS and Android, can raise development costs considerably. Every platform has different requirements, languages, and development tools, requiring more time, money, and experience. Because developers must create and maintain distinct codebases for each platform, this can increase costs.

But creating a cross-platform application with frameworks like Flutter or React Native can save money. These frameworks cut down on development time and eliminate the need for duplicate code by enabling developers to produce a single codebase that can be used on several platforms. This method guarantees a consistent user experience across various devices while also reducing development costs.

5. Tech Stack and Infrastructure

Finding the right technology stack influences not just performance but cost:

- Cloud solutions (AWS, Firebase) reduce infrastructure expenses

- Low-code platforms speed up development

- Native vs. cross-platform affects development hours

Developing a fintech app is less expensive with a smart tech stack without sacrificing quality. Choosing the best dev partner is critical to creating high-quality, low-cost fintech applications.

A seasoned business avoids problems like poor code or security flaws. However, knowledge should also encompass cutting-edge technologies like blockchain and smart contracts, which are essential for improved security and expedited transactions in the fintech industry.

Therefore, the right partner guarantees a high-quality, cutting-edge app in addition to long-term cost savings. Avoid over-engineering, expensive reworks, and blown budgets with a clear fintech development app estimate up front.

We’ve helped many clients with this process at LITSLINK, and our free app cost calculator is a great place to start if you want a customized fintech development app estimate.

Realistic Cost Estimates by App Type

Even though exact prices differ, the following is what we see generally:

Budgeting Apps

- Cost: $30,000–$80,000

- Why it’s lower: Fewer integrations, basic analytics

- Key Features: Expense trackers, goal setting, simple dashboards

- Example: Mint, PocketGuard

Payment Apps

- Cost: $100,000–$250,000

- Why it’s moderate: Security layers, KYC checks, APIs

- Key Features: Peer-to-peer payments, bank linking, biometric logins

- Example: Venmo, Cash App

Trading Platforms

- Cost: $200,000–$500,000+

- Why it’s high: Real-time data, AI analytics, compliance complexity

- Key Features: Portfolios, trading modules, price alerts

- Example: Robinhood, eToro

Enterprise Fintech Solutions

- Cost: $500,000–$2 million

- Why it’s highest: Multiple systems, roles, high security

- Key Features: Backend admin, customer portals, data reporting

- Example: Internal banking tools, wealth management systems

By being aware of these figures up front, you can prevent scope creep and make sure your vision fits within your available budget. The price of creating these applications can differ greatly. A simple mobile banking app, for example, might be less costly to create than a complex investment app with sophisticated features like fraud detection and data analytics. Accurate cost estimation requires knowledge of the unique features and requirements of each kind of app.

Hidden Costs You Can’t Ignore

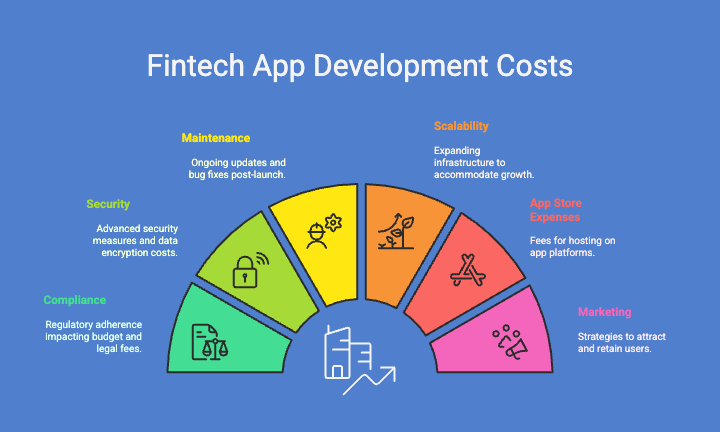

Many founders fail to consider the ongoing and hidden costs that go beyond the development price tag.

1. Compliance

Your annual budget may increase by 10% to 20% due to ongoing updates for evolving regulations (such as the CCPA, GDPR, and PCI-DSS). Additionally, anticipate an increase in legal consultation fees if your app serves multiple regions.

If you want to create a Fintech app, regulatory compliance is a crucial consideration. Because they must adhere to strict security, data protection, and financial services standards, including GDPR, PCI DSS, and regional regulations, maintaining a more comprehensive regulatory framework has an impact on costs.

2. Security

Security features are another element that has a big impact on the price of developing Fintech apps. Advanced security features like biometric authentication, secure API connections, etc., are more costly than basic security tools like username/password authentication.

Costs are also impacted by privacy and data encryption measures. It is less expensive to secure user data using basic encryption protocols rather than combining sophisticated encryption with sophisticated algorithms and stringent privacy controls for the Fintech app.

Crucial components include SSL encryption, 2FA, biometric login, penetration testing, and zero-trust architecture.

3. Maintenance

Your app needs to be updated frequently after it launches. These consist of OS compatibility modifications, server expenses, bug fixes, and API enhancements. The cost of yearly maintenance should be between 15% and 30% of the initial construction.

4. Scalability

Your server and database requirements will increase as your user base does. Although cloud-based infrastructure is helpful, engineers are required for effective scaling. Scaling the application with advanced features is a critical challenge for your fintech company after your MVP successfully enters the market. As you turn a simple application into a comprehensive financial platform, this expansion phase usually takes a lot of your overall development budget. For this stage, how much should you budget? The complexity and extent of the improvements you’re planning will determine how much they cost. The steps in the development process and the expenses of adding more features are important factors to take into account when creating a fintech app.

At LITSLINK, we’ve witnessed these expenses sabotage fintech launches that had otherwise shown promise. To ensure you are never taken by surprise, we account for them from the beginning.

5. App Store Expenses

There is a cost associated with hosting your app on sites like Google Play and the Apple App Store. Google Play requires a $25 one-time fee, while Apple charges a $99 developer fee that must be paid annually.

Both platforms assert a portion of every transaction made within the app, in addition to these up-front expenses. These costs need to be included in your financial plan because they can add up over time.

6. Marketing

As was previously mentioned, the fintech app market is quickly filling up, and it’s difficult to stand out. It is impossible to avoid spending money on user acquisition and a thorough marketing plan.

Every marketing strategy involves extra expenses, whether it is through paid advertising, social media, or SEO. A budget for loyalty programs, promotions, and customer relationship management tools is also necessary to draw in and keep users.

Read about the Best 8 Fintech Software Development Companies in our article.

How to Save on Fintech App Costs: Smart Strategies

Cutting corners is not the same as lowering the cost of fintech apps. It entails more intelligent construction. Here’s how:

Strategy 1: Launch with an MVP

Start with a single-purpose, lean product. Scale comes next.

- Begin with the essential features (such as transfers in a payment app).

- Verify user demand

- Later, include features like analytics or AI insights.

By doing this, you avoid creating features that no one uses and save time and money.

Strategy 2: Embrace Cloud and Low-Code

AWS, OutSystems, and Firebase are examples of tools that can:

- Decrease the complexity of the backend

- Reduced expenses for hosting

- Increase development by 30–50%.

Learn more about cloud computing benefits in banking.

Strategy 3: Outsource to Experts

Finding and managing an internal workforce is expensive and time-consuming. Hiring a fintech-savvy business, such as LITSLINK, for outsourcing:

- Reduces expenses by as much as 60%.

- Provides you with full-cycle development access.

- Uses agile workflows to shorten time-to-market

Here’s what makes a great app development team.

Strategy 4: Bake in Compliance from the Start

It can double your expenses to retrofit compliance into an app that has already been developed. To lower future risk and expenses, involve legal and security professionals in the planning stage.

This proactive approach is what we employ at LITSLINK, so your fintech product is compliant right away.

Timeline: From Idea to Launch in 2025

From conception to deployment, the process of developing a fintech app is complex and involves multiple steps. For companies and individuals hoping to develop a successful fintech app, it is essential to comprehend the complexities of fintech app development. Numerous factors impact the development process, and each one has a major impact on the total cost of developing a fintech app.

Budgeting effectively is aided by knowing your timeline. This is an example of a development roadmap:

Planning (1–2 Months)

- Outline goals and app type

- Prioritize features

- Identify required compliance and legal considerations

Development (3–12 Months)

- The timeline depends on app complexity

- Budgeting apps: 3–6 months

- Trading or enterprise apps: 9–12+ months

Testing & QA (1–3 Months)

- Includes security testing, compliance verification, and load tests

- Uptime and stability are crucial, especially in fintech

Launch and Maintenance (Ongoing)

- Real-time monitoring, customer feedback, and version updates

- Post-launch support typically runs 15–30% of the original budget per year

Agile sprints and milestone-based releases are the foundation of LITSLINK’s development timelines, which will help you stay on track and within your budget.

Conclusion: Budget Right, Build Big

There is no slowing down of the fintech boom. But it takes more than just a good idea to stand out in 2025. You need a clear grasp of your fintech app development cost, a scalable plan, and the proper partner to make it happen.

Successful project planning in 2025 requires an understanding of the numerous factors that affect the cost of developing a fintech app. The final cost is significantly influenced by the app’s complexity, technology stack, compliance needs, team location, and integration decisions.

The need for fintech solutions is only going to increase in the future. Blockchain and artificial intelligence (AI) may raise the cost of developing fintech apps, but they also open up new avenues for creativity and market dominance. Businesses can prosper in the ever-changing fintech landscape of the future by making wise decisions now.

Building a fintech app at a reasonable price guarantees that you lead rather than just launch.

We at LITSLINK have assisted both startups and large corporations in launching successful fintech applications on schedule, within budget, and in complete compliance.