What does it mean for companies when the IT services outsourcing market reaches $807.91 billion in 2025, with an expected 8.6% CAGR through 2030 to $1.22 trillion? For many decision-makers, it means more pressure to control costs, access skills, and scale software faster than ever.

Yet every business leader feels the pinch: global IT spend stands at $5.43 trillion in 2025, up 7.9% from last year, but firms still report a shortage of developers and rising demand for AI-driven engineering.

In this blog on software development outsourcing statistics, we break down the most recent data, market size, and regional changes. By the end, you will see how these shifts matter for your outsourcing strategy.

Key Trends and Statistics in Software Outsourcing (Beginning of 2026)

The year 2025 is a milestone. Spending, deal activity, and contract models all reflect a fast-changing outsourcing market. Companies do not just outsource for cost anymore; they now outsource for speed, AI integration, and access to scarce skills.

Let’s look at the software outsourcing statistics that matter most.

| Category | Key Statistics & Trends |

| Market Momentum | ITO market reaches $807.91 billion in 2025, projected to $1.22 trillion by 2030. Multiple sources confirm $591-662B range with 6-8% CAGR. |

| Global IT Spending | $5.43 trillion total spend (7.9% YoY growth); software outsourcing grows at double digits despite macro uncertainty. |

| Deal Flow | H1-2025 ACV $58.3B (+18% YoY); 14 mega-deals signed; ER&D services +72% to $1.1B in Q2. |

| Pricing Pressure | 35-40% price reductions from RFP to contract; developer rates down 9-16% in Eastern Europe, South Asia, SE Asia. Latin America is stable. |

| Skills Shortages | 47.2M developers worldwide, but 74% employers face hiring difficulty; 51% cite AI skills gap (largest in 15 years). |

| AI Integration | AI is central to outsourcing contracts for development, testing, and operations; vendors offering AI tools gain a competitive edge. |

| Nearshoring Growth | US firms favor Latin America; European firms choose Eastern Europe for better timezone/cultural alignment. Offshore (India/SE Asia) remains strong. |

These trends confirm outsourcing’s resilience and strategic importance for cost efficiency and specialized skills in 2026.

Global Market Growth in Software Development Outsourcing

The software development outsourcing market size is not just growing; it is reshaping. Buyers push for shorter contracts, outcome-based pricing, and shared risk models. Vendors respond with AI-driven delivery, multi-region delivery centers, and new commercial structures.

To explain this shift, we break down the key regions and drivers.

US Dominance in Software Outsourcing

The US remains the single largest client market for outsourcing providers. Reports show that US outsourcing statistics account for a huge share of the global $807.91 billion IT services outsourcing market. Companies in the US outsource not just to cut costs but to accelerate time-to-market in areas like AI development, cloud migration, and cybersecurity.

ISG’s quarterly data proves the trend: in Q2-2025, the Americas hit record demand, with managed services up 20% year-over-year and XaaS up 29%. This makes the US not just the largest outsourcing buyer but also the most aggressive in contract innovation and value-sharing models.

Businesses now see outsourcing as a growth enabler. For example, firms rely on offshore and nearshore teams to scale AI projects, while still controlling budgets. When you explore our programming outsourcing guide, you will see practical steps for building such distributed teams.

European Growth in Outsourcing

Europe shows steady expansion in outsourcing activity, especially in software and IT services. The region records slight contraction in managed services in Q2-2025, but digital transformation and AI integration drive continued demand. European CIOs are balancing cost containment with innovation requirements, making outsourcing a tool for flexibility.

In outsourcing statistics by country, the UK, Germany, and the Nordics dominate outsourcing contracts. Analysts note that European buyers are more cautious, often signing shorter contracts with renewal options.

But outcome-based clauses are gaining traction, with firms linking payments to KPIs such as cloud cost optimization or defect reduction.

| Metric (Europe 2025) | Value |

| Q2-2025 managed services ACV | −1% YoY |

| Average contract length | 2–3 years |

| Adoption of outcome-based pricing | Growing steadily |

For European companies, outsourcing is not just about cost efficiency. It’s about accessing talent pools in regions like Eastern Europe and ensuring flexibility in turbulent economic conditions. This shift reflects broader software outsourcing statistics worldwide.

Asian Expansion in Software Development Outsourcing

Asia remains the delivery powerhouse for outsourcing. India’s tech industry revenue hits $282.6 billion in FY2025, employing over 5.8 million professionals. The country is on track for $300 billion revenue in FY2026, with strong demand for engineering R&D and global capability centers.

Meanwhile, the Philippines continues to expand IT-BPM exports, expecting $40 billion in 2025 revenue and nearly 1.9 million jobs. Both countries rank high in outsourcing statistics by country, showing how Asia not only maintains scale but also expands into AI, platform engineering, and cybersecurity.

| Metric (Asia Outsourcing 2025) | Value | Source |

| India IT industry revenue FY2025 | $282.6B | NASSCOM |

| India projected FY2026 | $300B | NASSCOM |

| Philippines IT-BPM revenue 2025 | ~$40B | IBPAP |

| Philippines employment | ~1.9M jobs | IBPAP |

Asian providers also embrace AI-driven delivery. Many embed tools like Copilot and custom LLMs into daily workflows, which aligns with software development industry statistics showing productivity jumps of 20–45%. You can read how this impacts embedded systems in our outsourcing embedded software development article.

Remote Work & Its Impact on Outsourcing

Remote work continues to change outsourcing dynamics in 2026. Distributed teams are now the norm, not the exception. For many US and European companies, hiring offshore developers feels no different than hiring across states or countries.

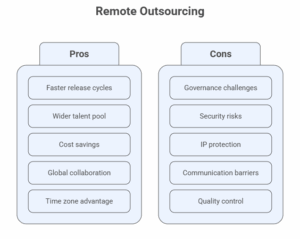

Software outsourcing statistics show that companies with globally distributed teams achieve faster release cycles because they can run projects 24/7 across time zones. At the same time, governance challenges increase. Buyers must invest in better secure SDLC, compliance frameworks, and AI usage policies to manage distributed software teams.

Remote work has reshaped outsourcing by making global collaboration easier and more natural. In 2026, companies in the US and Europe treat hiring offshore developers almost the same as hiring locally. Distributed teams allow businesses to tap into a wider talent pool, cut costs, and keep projects running smoothly around the clock.

Time zone differences, once a barrier, are now an advantage that speeds up software delivery and shortens release cycles. This shift has made outsourcing less about cost-saving alone and more about building highly flexible, global teams that deliver faster and adapt to market changes quickly.

However, remote outsourcing also creates new risks that businesses cannot ignore.

- With developers spread across different countries, governance and security challenges become bigger. Companies must strengthen software development practices with secure SDLC methods, compliance frameworks, and stricter policies on AI usage.

- Protecting intellectual property, ensuring data privacy, and maintaining consistent quality are now top priorities. Without strong oversight, the benefits of global teams can quickly turn into costly risks.

- For outsourcing to work in the remote-first era, trust, security, and clear communication are just as important as speed and cost.

Remote delivery also supports nearshoring. Many firms consider nearshore vs offshore outsourcing models to balance time zone overlap, cost control, and cultural alignment.

Future Outlook of Software Outsourcing (2026 and Beyond)

The future of outsourcing shows even faster movement than the current numbers suggest. Buyers want fewer, deeper partnerships. Vendors must prove they can deliver speed, AI productivity, and measurable business outcomes. Let’s unpack what comes next for the software development outsourcing market size and delivery models beyond 2026.

Shorter and Smarter Deals

KPMG notes buyers now sign shorter contracts but expand scope. Contracts run two to three years, often with renewal options and innovation funds. Buyers expect outcome-based pricing linked to KPIs like cloud cost per unit or defect escape rates. Deloitte adds that many firms are still building governance to capture cost savings, but the direction is clear: outcome orientation dominates new IT outsourcing statistics.

If you want to read more, our articles on 13 benefits of outsourcing software development for startups explain how our clients achieve this balance.

Talent Pressure Continues

Even with 47.2 million developers globally in 2025, shortages stay high. 74% of employers report difficulty filling roles, and 51% of leaders report AI skills shortages. This pressure ensures outsourcing will stay central to digital roadmaps. Buyers see outsourcing not just as a choice but as the only path to talent scale.

AI Productivity Becomes Standard

McKinsey shows 20–45% productivity gains in software engineering with GenAI. Controlled studies confirm GitHub Copilot users code 55.8% faster, and enterprise RCTs at Google show 21% cycle time reduction. This evidence means AI now sits inside every serious outsourcing contract. In practice, that means service providers must deliver faster, or buyers will hold them accountable for missed gains.

| Future Trend | Supporting Data | Source |

| Shorter contracts, broader scopes | 2–3 years average | KPMG 2025 |

| AI boosts engineering | 20–45% productivity gains | McKinsey |

| Developer shortage | 74% employers report a struggle | ManpowerGroup 2025 |

| AI skills shortage | 51% tech leaders report a gap | Nash Squared 2025 |

The software development industry statistics make it clear: outsourcing in 2025 and beyond will be about AI, measurable performance, and global reach.

Why Choose LITSLINK as a Leading Software Outsourcing Partner?

The outsourcing market in 2026 shows how much buyers expect from their partners. They no longer want long contracts filled with unclear promises. Instead, they look for measurable results, faster delivery cycles, and partners who adapt to the reality of AI-driven software development. At LITSLINK, we match this expectation by shaping every project around outcomes and real numbers.

Artificial intelligence now sits inside every project. In 2026, outsourcing partners rely on AI tools to speed up coding, testing, and project management. It no longer feels like an experiment; it works as a normal part of delivery.

We help businesses scale development with distributed teams while keeping cost efficiency and speed in balance. Our teams stay ahead of the curve by adopting AI-powered workflows, secure SDLC practices, and clear delivery milestones.

So the question is simple: Do you want to stay ahead in this $807.91 billion market or fall behind while others adopt AI and smarter outsourcing models?

Let’s talk today. Contact LITSLINK to build your outsourcing plan with a partner that understands today’s data, tomorrow’s risks, and the outcomes you need.