Artificial Intelligence (AI) is reshaping the wealth management industry, fundamentally transforming how financial institutions operate and interact with clients. AI-driven tools empower financial advisors to efficiently manage investments, uncover new opportunities, and deliver highly personalized advice.

Asset management firms are increasingly turning to AI to streamline compliance tasks, enhance operational efficiency, and foster stronger client relationships. With AI-managed assets projected to approach $6 trillion by 2027, the adoption of AI signifies not just an industry trend, but a critical evolution in financial services.

AI applications in wealth management provide robust data analysis capabilities, market trend forecasting, and improved client interactions. These advanced analytics and automation capabilities help financial institutions make better-informed decisions, enhance financial planning services, and automate routine tasks, positioning AI as an integral component of wealth management now and in the foreseeable future.

In this article, we explore the current state and future outlook of AI in investment management, highlighting key benefits, real-world applications, and strategic insights for adopting AI effectively within your business.

The Potential of Wealth Management AI

A recent study revealed that 9 out of 10 financial advisors feel optimistic about the impact of Artificial Intelligence in the banking sector and believe that the new technologies can grow their financial services by over 20%.

According to Business Wire, the share of AI in the banking sector is projected to reach $63.03 billion by 2030. Other research says that 95% of asset managers’ technology, digital capabilities, and data will be differentiators in 2025. And FinanzOnline states that 67% of US-based businesses agree that AI technology adoption has already helped boost customer experiences.

The world’s financial software development isn’t standing still. Top financial institutions have already introduced ML algorithms and AI to their business processes and seen transformative effects.

Morgan Stanley

After the company introduced generative AI to its processes, Morgan Stanley formed a test group of around 1000 financial advisors to see how their AI chatbot tailored for wealth management would perform. The chatbot was expected to deliver profound assistance, including:

- retrieving research

- offering reliable insights

- managing administrative tasks

- cutting the need to scan the documents manually

- generating meeting summaries

- sending follow-up emails

- scheduling appointments

- handling sales databases

The solution aims to support advisors with their administrative tasks and preserve the human touch of their services favoured by most Morgan Stanley clients.

Ant Group

The Ant Group introduced a finance-focused LLM (large language model) and two AI-based wealth management solutions to show their commitment to current trends and readiness to meet the new standards. Their Zhixiaozhu 1.0 will be public after all rounds of regulatory approvals, while their Zhixiaobao 2.0 is undergoing final testing to provide trustworthy answers to financial queries.

Deutsche Bank

Deutsche Bank has focused on using AI for security risk and fraud prevention. They are now testing AI tools (namely, Google Cloud’s ML) to detect possible misconduct from traders’ phone calls. The Bank is training Artificial Intelligence via recorded trader calls to allow AI to understand diverse speech and language nuances. Their biggest concerns are probably bias and moral scruples. Yet, this is only one of the many ways they hope AI could improve their services: client & employee support, misconduct monitoring, and code assistance.

Obviously, AI in investment banking will have a measurable impact on the client-advisor relationship in the next 18 months. A company with AI will be able to deliver more sophisticated advice and planning, leaving others trailing behind.

Benefits of AI in Asset Management

There’s a reason why AI and Machine Learning in wealth management have become so trendy: they bring benefits that no other technology can offer beyond the introduction of business virtual assistants or AI chatbots:

- Data-driven insights for enhanced decision-making

- Quick and efficient data analysis

- Personal recommendations based on risk tolerance, preferences, and individual goals

- Automation of routine tasks (data entry, report generation, portfolio rebalancing)

- Regulatory requirement analysis and detection of anomalies

- Increased efficiency across company departments

- Nurture a relationship with a current client base

- More effective marketing strategies

But, the main benefit is reduced operational costs, resulting from the eight core benefits mentioned above.

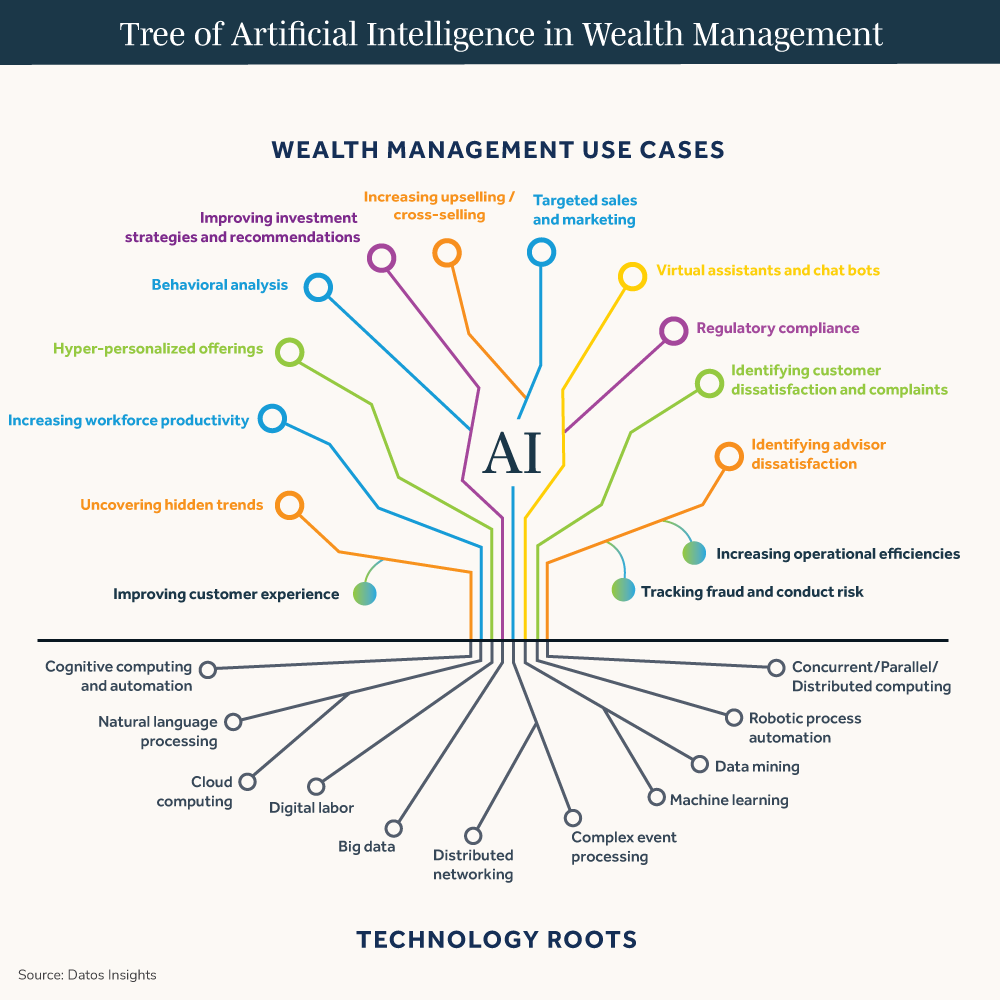

How Artificial Intelligence is used in Wealth Management

AI use cases in wealth management aren’t just limited to the ones we’ll deliver below: as AI is changing the world at enormous speeds, the number of AI use cases is constantly growing.

Lead generation

Lead generation for the wealth management sector is challenging and time-consuming, so organizations are looking for ways to make it simpler. The introduction of AI in investment management can assist: AI-based instruments quickly analyse large sets of real-time and historical data, determining possible prospects faster and easier. AI-driven tools even use publicly available information like that in social media to identify potential clients whose image aligns with the company’s ICPs.

Financial planning

Financial planning includes tax planning, cash flow management, and trusts. Financial experts handle numerous documents and complicated calculations to ensure top efficiency so that their clients receive well-planned, step-by-step recommendations that eventually prove efficient for diverse future scenarios. AI offers advanced data analysis and natural processing tools that liberate overloaded financial experts from routine tasks and micro planning, allowing them to concentrate on more important matters.

Risk management

The global value of AI for financial advisors is in its predictive capabilities. Many financial institutions are now focused on developing AI instruments that allow their advisors to stay proactive in mitigating risk. Once the instrument analyses large market and economic data sets, it can forecast downturns and volatile periods, freeing up more time for advisors to take action, safeguard portfolios, and develop a secure environment.

Fraud detection

Fraud is a massive risk to wealth management companies and banking institutions of any size. Artificial Intelligence has revolutionized the financial sector by closely examining transaction patterns, detecting abnormalities, and thus identifying and preventing fraudulent activities. On the one hand, Artificial Intelligence in investment bolsters a company’s security. On the other hand, AI technology builds client trust in the company and the safety of their investments.

Compliance

ML algorithms are taught to scan and analyse regulatory requirements, identify possible inconsistencies, and flag compliance & regulation violations. This is how AI-driven technologies assist financial institutions in streamlining their compliance processes and mitigating related risks.

Institutional memory

Advisor-client cooperation is accompanied by a large amount of shared data. Retaining everything on paper is outdated. Storing data on personal computers is not secure. Portfolio management systems are the best option, but quickly finding relevant data is impossible when hundreds or thousands of pages are stored. AI instruments help to increase monitoring and supervisory activities to find room for improvement through automated content review.

Tax analysis

The complexity of tax scenarios is easier to unravel with AI tools at hand. They can deliver valuable insights helpful in tax management and planning. Moreover, they consider multiple tax regulations and implications, design the most efficient strategies, and ensure the company’s client complies with tax laws.

Bottom Line

In the past, AI was often focused on developing entertainment apps for video and image processing rather than being viewed as a serious tool for investment management. Recent social changes have shown that AI and ML instruments have more potential. Many financial institutions now see a significant opportunity to adopt AI to progress beyond the PoC stage in the coming years. If you’re also planning to leverage AI to gain a competitive edge, contact us. We’ll accelerate those efforts to allow your business to reap the maximum benefits.