Data science is not merely a buzzword in today’s quick-paced digital universe; it is a game-changer. With an estimation of the size of its global marketplace for data science, from $95 billion in the year 2021 to $322 billion by 2026, the world is busy rummaging through data science potential. Any industry—from healthcare to finance and e-commerce to entertainment—has its words changed for incorporating Artificial Intelligence (AI) and Machine Learning (ML) into workflows. How does Spotify combine your perfect playlist, or how does Amazon know what you will buy next? How can Netflix predict what you’d like to watch? That is data science for you.

As 2025 creeps toward the horizon, rapid changes in data science are apparent. These may range from the emergence of ethical AI to the mind-blowing facilitation of graph analytics and blockchain integration; staying ahead of these trends is not just an advantage but also a forced necessity. For a startup with evolving predictive analytics or a global firm redefining customer experiences, understanding such shifts may be the secret to practical survival in a cutthroat market.

This article discusses the latest trends in data science that will define the domain in 2025 and provides applicable guidelines for continuing to advance. Delving into these technologies, tools, and techniques, which are reshaping industries and the future, will undoubtedly ignite the transformation.

What Makes Data Science Essential?

As the world becomes increasingly data-driven, businesses and organizations must adapt to keep up with the latest trends and advancements in data science. Thanks to new technologies and tools, data scientists can now extract insights from vast amounts of data more efficiently and accurately than ever before. As we look to future trends, it is essential to keep up with the latest data science trends to maximize our potential and stay ahead of the curve.

Data Science has emerged as a crucial field for organizations across various industries as they seek to make data-driven decisions. With the exponential growth of data, businesses are constantly searching for novel and innovative ways to utilize this data to gain insights that help improve operations, enhance customer experience, and increase profitability. Data science trends refer to the emerging technologies, tools, and techniques used to manage and analyze data.

In recent years, data science innovation has advanced greatly, and this trend is set to continue as the world becomes increasingly data-driven. With advancements in Artificial Intelligence (AI), Machine Learning (ML), and Big Data, organizations can now leverage their data to make accurate predictions, automate decision-making, and gain a competitive edge. The need for data science professionals who can harness the potential of these emerging technologies has never been higher.

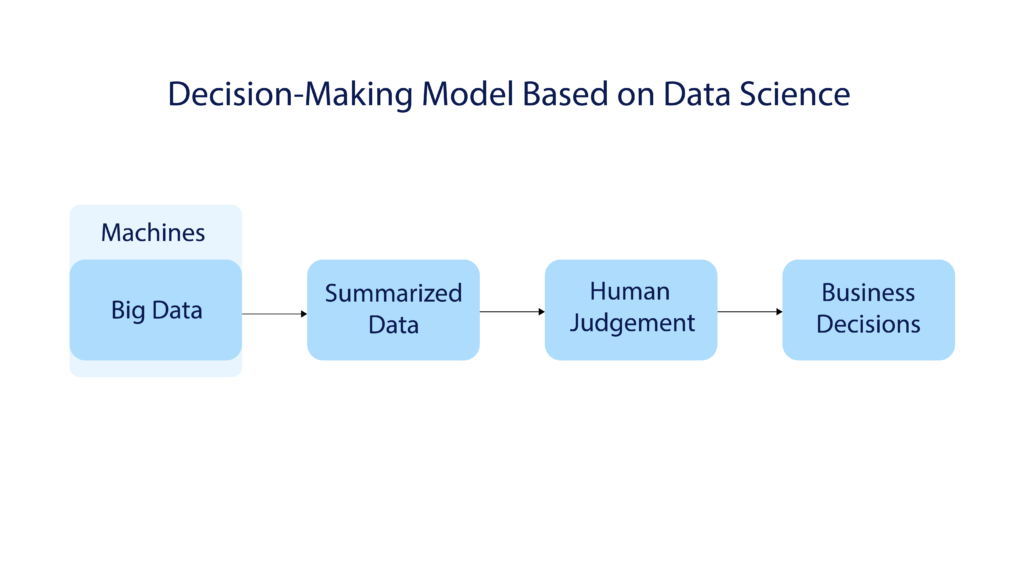

One of the most significant new trends in data science innovation is the democratization of data. As more data is collected, individuals and organizations outside the traditional data science field are seeking to gain insights from it. Self-service Business Intelligence (BI) tools have made it easier for non-technical users to access and analyze data, allowing organizations to make data-driven decisions across departments. Another data science trend is the integration of AI and ML into data science workflows. These technologies have the potential to automate repetitive tasks and augment human decision-making, leading to more efficient and effective data analysis.

As organizations continue to invest in data science, there is a growing emphasis on ethics and transparency. Privacy and security have become critical issues, and data scientists must ensure that the information they use is ethical and transparently sourced. Explainable AI is also gaining traction as organizations seek to understand how AI models make decisions.

Data Science Trend #1: Advancements in AI Intelligence and Speed

Artificial intelligence is widely applied across all business sectors, helping companies address their business challenges. If 10 years ago, you had been wondering how Netflix knew your favorite movies, today, you’re pretty aware of its smart recommendation system and the AI algorithms behind it.

In 2025, artificial intelligence promises to become even smarter and faster. Companies are expected to shift from piloting to operational AI, which will significantly increase streaming data and improve analytics infrastructure.

In the context of the current COVID-19 crisis, AI solutions, along with machine learning and natural human language processing, can provide vital predictions about the spread of the virus. Technology industry experts have already found a way to use AI innovations to detect infected individuals, spot patterns, and develop possible solutions to complex issues. See our AI case study to find out how LITSLINK helped build a people counter software that assists businesses in implementing preventive measures and keeps a limited number of people in the building.

Data Science Trend #2: The Rise of Graph Technology and Analytical Methods

Graph technology and analytics refer to the use of graph databases and algorithms to analyze relationships and connections between data points. These data banks are a type of NoSQL database that stores information in nodes and edges, where nodes represent entities and edges represent the relationships between them.

Graph analytics, on the other hand, involves the use of algorithms to discover patterns, insights, and anomalies within data analytics. These algorithms are designed to take advantage of the graph structure to analyze the interrelationships between data points.

Graph technology and analytics are increasingly used in various industries, including finance, healthcare, and social media, to identify patterns in data and make better-informed decisions. They enable businesses to gain more profound insights into customer behavior, optimize supply chain management, and improve fraud detection.

What is Graph Data Science?

Many companies mistakenly believe that the more data analytics they gather, the better their final results will be. By accelerating computer power, they strive to process more information in less time, believing this will provide them with more insights and help them find the competitive advantage that will make them leaders in the world of tomorrow.

However, in most cases, it doesn’t matter how much valuable and structured data analytics you process if you lack an understanding of context. If the relationship between data patterns is missing, you won’t be able to turn information into meaningful insights.

This is where graph technologies are introduced to map data sets and understand relationships between them. This approach might help you find common patterns, drive contextualization, and develop more valuable products to meet your business challenges.

How Can Businesses Leverage The Power of Graph Data Science?

In the next 3–4 years, we’ll witness rapid growth in the application of graph technologies. More than 30% of organizations will use graph analytics software to drive greater contextualization in decision-making.

New advancements in graph technologies can comb through large amounts of documents, research papers, surveys, statistics, and other pieces of information to build connections between data analytics sets and draw relevant conclusions. When applied to business administration, graph analytics might help companies spot issues early, develop accurate predictions, and make data-driven decisions based on the insights they get.

In the context of the current coronavirus crisis, graph technologies can assist healthcare professionals in finding common patterns in the spread of the virus, which will contribute to a better understanding of the disease. Thus, a data-driven approach to the issue might help develop better capacity plans, find new treatment methods, and devise effective preventive measures.

It is also predicted that prescriptive graph analytics combined with artificial intelligence software will become a top data science instrument for identifying and predicting natural disasters. Graph technologies can cover the whole solution development cycle from planning to implementation, helping specialists deliver better results and improve the public health system.

Data Science Trend #3: Integration of Blockchain Technology in Data Science

Blockchain technology has the potential to revolutionize the data science industry by enhancing data security, transparency, and privacy. In the context of data science, a blockchain is a distributed and immutable ledger that enables secure and transparent transactions between parties without the need for intermediaries.

Unlike fintech and healthcare, where blockchain has already become a household term, data scientists only started to explore the whole potential this industry technology can deliver to the industry.

Blockchain can address the two major challenges data scientists face today.

First, decentralized ledgers provide a brand-new way of managing and operating big data. As a rule, you need to structure the information in a centralized manner, where all data sets are brought together for further analysis. This process takes some time as you need to gather and structure the information properly before getting down to “science”.

Data scientists can use the blockchain’s decentralized structure to conduct analysis from individual devices. As blockchain ascertains the origin of data, you can always track where it comes from and validate it.

Second, blockchain infrastructure guarantees transparency for complex networks of participants. When you need a helicopter view of all operations, decentralized infrastructure can help you track them, see relations between data analysis sets, and check their origin.

Gartner estimates that data management systems (DMBS) will substitute for the majority of permissioned blockchain applications. Since DMBS provides a more comprehensive way of operating big data sets, companies will be able to see more opportunities to utilize data science and uncover at least a fraction of its potential.

Apart from existing blockchain applications, this technology industry can provide an appealing opportunity for small and medium-sized enterprises. Blockchain can be used to audit existing data sources and build a reliable data-based infrastructure where all participants can track the origin of information and access available data resources. This approach builds transparency and enhances the security of the stored data.

Blockchain networks’ ability to handle large volumes of transactions while maintaining performance and security is called interoperability. Interoperability refers to the ability of different blockchain networks to communicate and work together seamlessly. Governance refers to the need for clear rules and protocols to ensure that blockchain networks are secure, transparent, and accountable.

Another challenge is the lack of standardization in the development of blockchain technology. There are many blockchain platforms and protocols, each with its unique features and capabilities. This makes it difficult for businesses and organizations to choose the right platform for their needs and integrate blockchain technology into their existing systems.

Overall, blockchain technology offers significant potential to enhance data security, transparency, and privacy in data science applications. However, it is important to note that the technology is still in the early stages of development. Many challenges must be overcome before it can be widely adopted.

Thus, we may conclude that blockchain is an inexhaustible resource for data science, which, when handled well, can lead to innovations in artificial intelligence.

Case Studies of Successful Implementations

The latest trends in data science can demonstrate a worthy revolutionary capability that can be replaced with these new technologies. Some of the examples of industries making use of recent developments in data science include:

-

Healthcare: AI Enhancing Patient Outcomes

Prominent healthcare providers such as Neko Health and South Australian Medical Imaging (SAMI) use predictive analytics powered by AI-enhanced patient care. The health establishment tracks records, values, and historical data to develop a system that predicts high-risk patients and intervenes before complications emerge. This effort reduced hospital readmissions, not to mention the significant improvement in patient satisfaction.

-

Finance: Graph Technology for Fraud Detection

Multinational financial institutions adopt graph technologies, such as NVIDIA’s Graph Neural Networks and Amazon Web Services, to combat fraud. These systems use graph databases and algorithms to map complex transactional relationships and identify anomalies in real time. They help detect fraudulent activity faster and have saved millions in potential losses annually.

-

Retail: AI-Powered Personalization

Amazon, Alibaba, and Walmart’s personalized e-shopping was attributed to a boost in sales, even improving customer loyalty, to make an e-commerce giant implement machine algorithms on its recommendation engine better. They achieve the boost through purchase behavior, history, and real-time behaviors of users on the platform.

-

Supply Chain: Blockchain for Transparency

Logistics companies use blockchain technology in their supply chain operations. Immutable transaction records mean higher transparency and accountability in these operations. To date, the innovations have reduced disputes with suppliers and improved delivery times.

Data Science Lifecycle

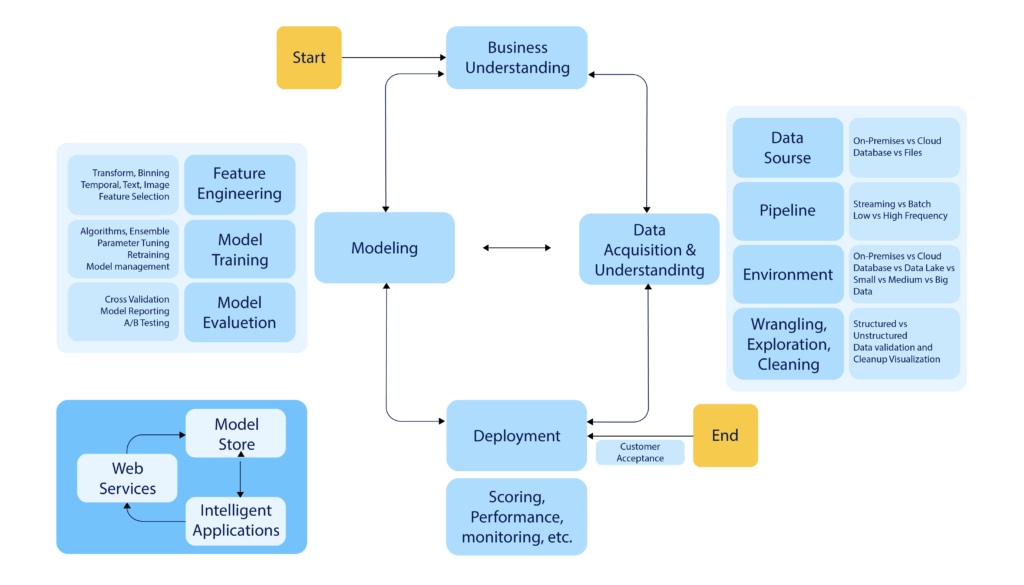

The data analytics lifecycle serves as a comprehensive framework guiding data science projects from inception to completion. This iterative process encompasses multiple stages, each building upon the previous one to ensure project success.

While staying abreast of emerging data science trends is crucial, it’s only part of the equation when it comes to developing a successful data science product. Understanding the intricacies of the data science lifecycle is imperative for creating solutions that resonate in the global market.

The Data Science Process offers a structured roadmap for developing your data science solutions. It outlines key milestones to guide your team in building high-quality software that aligns with your business objectives.

This lifecycle is particularly effective for developing intelligent applications that leverage artificial intelligence and machine learning to construct predictive analytics models. Additionally, it can be adapted for exploratory data science projects or enhancing analytics software. However, customization may be necessary to address specific business requirements, potentially involving the addition or modification of certain lifecycle steps.

Ethical Considerations in Data Science

As data science is increasingly ushered into the enterprise level and people’s daily lives, ethical issues arising from this technology have become very serious. This has ensured that data-driven technologies are used rightfully and fairly.

Below are some of the ethical issues in data science and the approaches organizations are which can navigate them:

-

Bias in AI Models

AI models tend to ”inherit” the biases they might have recorded during their training as data input. Hiring algorithms, for example, regulated by biased datasets, have been reported to favor certain demographics over others and deny such demographic groups qualification for employment.

Organizations must invest resources in developing diverse datasets, creating fairness metrics during model development, and periodically auditing the entire AI system to detect bias and address the issue.

-

Privacy Concerns

Private data by big data has become a critical issue for users. It is known to gather an enormous amount of information from users that is more than required. Access to such data has made users vulnerable to data breach/usage against their wishes. Organizations must ensure suitable data governance mechanisms, anonymize sensitive information, and comply with privacy laws, such as GDPR and CCPA.

-

Transparency and Explainability

Most AI and machine learning models act like “black boxes” through which very few decisions can be viewed, along with what actually happens inside them. This kind of functioning may damage trust and create illicit use. There exist means in which the very foundation for explicable AI (XAI) offers information about how models derive decisions: employing such means may facilitate businesses in establishing trust among users and stakeholders while keeping accountability.

-

Ethical Data Sourcing

Consent and legality are issues that surround data sourcing. For example, scraping data from social media without the consent of the relevant users is ethically, and in many cases legally, questionable.

-

Balancing Innovation with Responsibility

Rapid advancements in data science often outpace the development of ethical guidelines. Striking the right balance between innovations and responsibilities requires involving ethicists, policymakers, and domain experts in the decision-making process.

-

Environmental Impact of AI and Data Science

In short, AI and data science have an environmental impact when training AI and deploying complex models, which usually consume a great deal of energy and lead to carbon emissions.

Adopting energy-efficient algorithms, sourcing renewable energy to power data centers, and changing the model complexity to reduce environmental footprint

Addressing these ethical issues is not a question of compliance; instead, it is an issue of creating public trust—the justification for the place in question concerning the benefits of data science advances to all of society. Ethical concerns will not only spare organizations reputational risks but also help gain competitive advantage through building long-term trust and sustainability.

Future Skills for Data Scientists

The data science evolution demands that professionals constantly update their skill sets. As the field expands into new domains and technologies, these are the emerging skills:

Proficiency in AI Ethics: Understanding how to design and implement ethical AI systems will be critical for addressing issues like algorithmic bias and ensuring compliance with global regulations.

Advanced Machine Learning Techniques: Expertise in advanced machine learning (ML) approaches such as deep reinforcement learning, generative adversarial networks (GANs), and transfer learning enables data scientists to build cutting-edge models.

Graph Analytics and Graph Technology: As the use of graph databases and technologies like Neo4j and TigerGraph grows, the ability to analyze relationships and connections within data is emerging as a must-have skill.

Cloud Computing and Data Engineering: With the majority of data processing moving to the cloud, familiarity with platforms like AWS, Google Cloud, and Azure is essential.

Natural Language Processing (NLP) and Large Language Models: Data scientists must master techniques for fine-tuning these models and using them for applications such as chatbots, sentiment analysis, and content generation.

Data Storytelling and Visualization: Skills in data visualization tools like Tableau, Power BI, and Plotly, combined with an understanding of storytelling principles, will help data scientists present their findings to non-technical audiences.

Domain-Specific Knowledge: Domain expertise, whether in healthcare, finance, retail, or manufacturing, can give data scientists a significant edge when developing tailored solutions.

Automation and MLOps: Proficiency in MLOps (Machine Learning Operations) tools like Docker, Kubernetes, and MLflow will allow data scientists to streamline workflows, automate model deployment, and ensure scalability.

Hybrid Skills: Combining AI with Other Disciplines: As these fields converge, interdisciplinary skills, such as those combining AI with robotics, IoT (Internet of Things), or cybersecurity, will be highly valuable.

Continuous Learning and Adaptability: As new tools and techniques emerge, staying ahead of the curve will require a commitment to lifelong learning through certifications, workshops, and keeping up with industry trends.

Mastering these future-oriented skills will position data scientists for success and ensure they remain indispensable in driving innovation and solving complex challenges across industries. To ensure that your team has the needed skills and expertise, consider outsourcing. Learn more about the benefits and pitfalls of data science outsourcing in our blog.

Data Science Tools and Platforms for 2025

With the evolution of data science, the tools and platforms that power it have become more sophisticated and specialized. In 2025, these technologies will be crucial for data scientists in their quest to analyze, model, and visualize data efficiently.

So, here is a list of trending tools and platforms that are helping to shape the future of data science.

Machine Learning Frameworks

- TensorFlow

TensorFlow is a flexible and scalable framework for developing very complex deep-learning architectures. It is, therefore, used in image recognition, natural language processing applications, and reinforcement learning. - PyTorch

PyTorch’s intuitive design and dynamic computation graph make experimentation simple. It is the preferred choice in research settings and has gradually entered production environments for use cases such as computer vision and advanced natural language processing. - Scikit-learn

Scikit-learn is a complete library of both supervised and unsupervised learning algorithms. It is suitable for regression, clustering, and classification tasks.

Big Data Processing Platforms

- Apache Spark

Apache Spark can process vast volumes of data in real time while handling machine-learning workloads, making it a foundational platform for businesses that use big data. - Databricks

Databricks integrates data engineering, data science, and machine learning with a single workspace built on Apache Spark. It simplifies teamwork across workflows and is optimized for the current cloud, making it a favored product with modern organizations.

Visualization and Business Intelligence Tools

- Tableau

Tableau’s intuitive drag-and-drop interface enables users to create interactive dashboards that provide actionable insights. - Power BI

Power BI from Microsoft integrates well into various Microsoft products and is widely used for generating in-depth interactive visual reports. Its low-cost deployment and its user interface are a boon not only for larger corporations but also for startups.

Graph Technology

- Neo4j

With graph analytics gaining ground, Neo4j has emerged as the preferred platform for exploring and analyzing relationships within data. Such applications encompass social network analysis, fraud detection, and recommendation systems.

AI and NLP Tools

- Hugging Face Transformers

Hugging Face revolutionizes NLP by providing an array of language models and pre-trained models for tasks such as text summarization, translation, and sentiment analysis. Its very friendly user interface makes it accessible to researchers and practitioners. - OpenAI’s GPT Models

Language models such as GPT-4 and above, developed by OpenAI, are setting the newest standards in generative AI. These engines are widely adopted in chatbot development, text generation, and creative content generation.

Data Management and Integration

- Snowflake

Snowflake is a scalable and performant cloud-native data warehouse suitable for organizations that handle huge data sets for storage, integration, and analysis. - Google BigQuery

Another very similar serverless platform that Google provides to query and analyze huge datasets is BigQuery. This open-source tool is also great for companies using Google Cloud.

Emerging Platforms to Watch

- DataRobot

DataRobot dedicates itself to automating machine-learning workflows, allowing companies to deploy models fast without sufficiently knowing how to code. - Streamlit

Streamlit is gaining traction for its ability to create interactive web applications quickly and effectively for data science projects. - KNIME

KNIME enables people to create workflow in a few clicks without raw coding, and it is suitable for companies with different levels of know-how.

Why These Tools Matter

The 2025 big data science landscape requires skills in tools and platforms that address many challenges, such as combining massive datasets, achieving explainable AI, and forcing collaboration across teams. By mastering these technologies, data scientists will gain a competitive advantage and assure themselves of lasting assets for pioneering innovations.

Staying abreast with the tools and platforms allows organizations to allow their data teams to draw meaningful insights and remain competitive in the increasingly data-driven landscape.

Final Note

Data science is a rapidly evolving field, so staying up-to-date with the latest trends in data science and technology is crucial for professionals and organizations. To succeed in this field, data analytics scientists should focus on developing a strong foundation in mathematics, statistics, and computer science, as well as keeping up with the latest tools and techniques in the industry. Additionally, soft skills such as communication and teamwork are becoming increasingly important in the data analytics field.

Knowledge is power. In business, being aware of industry data science trends can give you a competitive advantage and set you apart from your rivals.

To capture the full potential of data analytics science and successfully apply it to your business, read our insightful white paper catered to you by the top industry experts.