How do you build your business dream when you don’t have the money to start? That question keeps many founders up at night. Finding money can feel like a roadblock even when the idea is strong. Most new business owners struggle with where to start, who to ask, or what they’re doing wrong. In 2024, U.S. venture capital made a comeback.

AI startups alone took 46.4% of the $209 billion raised. That’s a huge shift from under 10% ten years ago. It shows one thing clearly, investors are still writing checks, but only for the right story and growth plan. This momentum reflects the evolving landscape of fundraising for business in today’s economy.

If you’re trying to figure out how to raise funds for business, you’re not alone. But timing, source, and structure matter more than ever now when raising finance for a business.

Understanding the Fundraising Lifecycle for Businesses

Before you try to raise capital for your business, it’s key to understand how funding works across stages. Each round has a goal. Investors look for different things at each point. You must know where you are in this cycle so you pitch right.

- Pre-seed: Early idea stage. Founders use their own money or get funds from friends. Usually no product yet.

- Seed: Product development begins. Investors want to see potential. You show prototypes and early user feedback.

- Series A: You found market fit. Now it’s time to scale. VCs want traction, a growing team, and a clear revenue model.

- Series B: Growth and expansion. You’re refining systems. Bigger investors enter. Capital supports customer acquisition.

- Series C and beyond: Big scale and M&A prep. You go international or improve infrastructure. Large institutional investors step in.

- Exit: Could be IPO or acquisition. Founders and investors get returns here. Everything before this builds toward the exit.

Raising funds often goes hand in hand with having the right team in place to bring your vision to life. Many startups choose to hire skilled developers to quickly build MVPs and attract investors.

Where to Raise Funds for Your Business: Top Funding Sources

Let’s break down where to raise funds for a business. Each source has different terms, timelines, and expectations. You should pick based on your stage and how much control you want to keep.

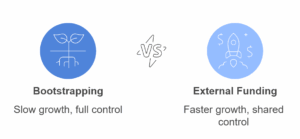

Bootstrapping

Bootstrapping means using your savings or profits from early sales. No external money. This path is slow but keeps full control with the founder. It works best for small businesses with low upfront costs. For example, a software developer launching a micro-SaaS product can build a basic version and get early users without outside capital.

Tips:

- Keep your expenses very low.

- Focus only on things that directly drive revenue.

- Sell before building a full product if possible.

As you prepare your pitch, it’s also important to be aware of external and internal factors that can affect business growth. These key business risks are worth considering when planning your funding strategy.

Friends and Family

This is often the first stop for early founders. It’s easier to convince those who trust you. But mixing personal relationships and fund raising for business can create tension.

Tips:

- Treat it like a real business deal.

- Set clear terms, debt or equity?

- Write agreements even with close ones.

A bakery owner borrows $15,000 from cousins. It works only because she gives them a 5% equity share and agrees to profit payouts every quarter.

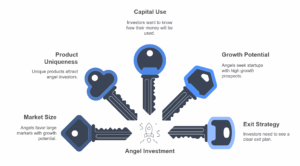

Angel Investors

Angels are high-net-worth individuals who invest their personal money into early startups. They usually invest in the seed stage. They’re more flexible than VCs but still want returns.

Tips:

- Angels prefer big markets and unique products.

- Show how you’ll use their capital.

- Focus on growth and exit potential.

Venture Capital

Venture capital firms invest larger amounts into high-growth startups. They look for companies that can return 10x. But they demand equity, control, and expect fast growth.

Tips:

- You must show traction, users, revenue, or tech.

- Be ready to give up board seats.

- Have a 5–10 year exit plan.

A mobile payments app hits 50,000 users. A VC firm invests $2 million for 20% equity and helps with partnerships.

Innovative ideas with strong tech foundations tend to stand out to investors.

Exploring revolutionary AI business ideas can help you identify concepts with real market potential.

Bank Loans and Credit Lines

Banks offer loans based on credit scores and collateral. This is a debt model, not equity. Ideal for steady businesses with assets.

Tips:

- Good credit is key.

- Use for working capital or equipment.

- Always compare interest rates and repayment terms.

Government Grants

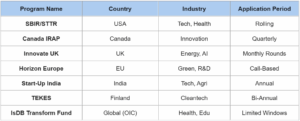

Governments offer grant programs to support innovation, exports, and local job creation. These don’t require repayment, but the process is strict.

Tips:

- Follow the eligibility criteria.

- Be very accurate with your application.

- Track milestones.

Example: A startup in renewable energy gets a $75,000 grant to develop solar tech through a state green fund.

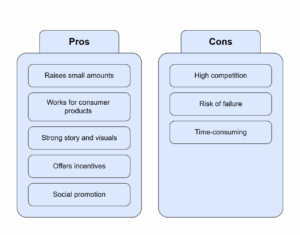

Crowdfunding Platforms

These platforms let you raise small amounts from many people. You create a campaign with story, video, and offers. Works well for consumer products or social ideas.

Tips:

- Have a strong story and visuals.

- Offer something in return, early access, discount, or equity.

- Promote it hard on social.

Platforms: Kickstarter, Indiegogo, Republic, Wefunder.

Best Ways to Raise Capital for a Business Venture

There’s no one-size-fits-all method when looking for the best way to raise funds for business. The right method depends on your industry, stage, and long-term vision.

But founders must always understand how money raised for a business venture affects control, taxes, and ownership.

Equity vs. Debt Financing

Equity: You sell part of your company. No repayment, but loss of some control. Ideal for startups that plan to scale fast.

Debt: You borrow capital and repay with interest. You keep full ownership but must handle regular payments.

Choose equity if:

- You need big funds and can’t repay quickly.

- You’re aiming for high growth and a future exit.

Choose debt if:

- You want to keep ownership.

- You have cash flow to repay monthly.

Convertible Notes

These are short-term loans that convert to equity later, usually during a priced funding round. This is common in seed-stage investments.

Benefits:

- No need to value your startup now.

- Investors get early rights and discounts later.

Revenue-Based Financing

Here, you raise capital in exchange for a share of your revenue until a fixed amount is paid. It’s non-dilutive and adjusts to your growth.

Tips:

Strategic Partnerships

These are collaborations where a larger company invests or supports in exchange for joint growth, tech, or market access.

Tips:

- Have something unique they want, IP, user base, market access.

- Negotiate terms carefully.

- Share resources, not full ownership.

Social impact can also attract modern investors who value purpose alongside profit. Many founders are turning to technology for social change as a powerful part of their business narrative.

Grants and Government Funding Opportunities

Many startups ignore grant options because the process feels too hard. But government funds are real ways to raise funds for business, especially if you’re solving public problems or building technology.

Research indicates that augmenting crowdfunding campaign narratives using AI can increase the likelihood of securing financial support by 11.9%, demonstrating the potential of AI in improving fundraising outcomes for small businesses.

Streamlining operations through automation can show funders your business is built for scalability. These insights on how automation helps business reveal the value of efficiency-driven strategies.

Tips for a Successful Fundraising Campaign

According to Statista, the global crowdfunding market is projected to grow by 1.35%, hitting $1.14B by 2027. To succeed in raising money for business, timing, clarity, and trust matter most. It’s not just about asking for cash.

- Build investor trust with clear data and honest goals.

- Tailor your story to fit each investor’s interest.

- Make sure your numbers add up before you pitch.

- Set deadlines to push urgency and decisions.

- Ask other founders for feedback before going live.

If you’re shaping your tech roadmap as part of a funding round, expert input can make a difference. You can contact LITSLINK to explore how we can support your product development goals.

Why LITSLINK Is the Right Tech Partner to Support Your Funded Growth

Now that you know how to raise capital for business expansion, you’ll need a strong tech team to deliver on your promise. That’s where we come in. At LITSLINK, we work with startups from MVP to scale.

If you’ve just figured out how to raise fund for business or you’re deep in Series B, we can help. We don’t just write code. We think about product, growth, and user. Our engineers and designers understand what fast-growing teams need.

You need speed, support, and skill when you finally get funds for business. We bring all three. Choose LITSLINK, and we’ll become your most reliable partner for building apps and smart business tools.