What if the secret to charming tomorrow’s insurance customers was already tucked into that little device they carry everywhere? You know how it is—people are glued to their smartphones, sorting out bank accounts or snagging plane tickets with a flick of a finger. Yet, here we are, with too many insurance companies still shuffling papers and tying up phone lines like it’s 1995. That’s not just old-fashioned—it’s a pricey slip-up.

Word from the wise says that at the end of 2024, a whopping 85% of grown-ups in the U.S. were active users of mobile banking. And it’s not just them—down in Australia, 73% of people reckon they should be able to sort any money matter with a quick swipe on their app. Over in the UK, 68% are nodding along, and back in the States, 65% are saying the same.

Take a peek at the trailblazers cashing in already. There’s Lemonade, an insurance company, turning the slog of filing claims into a breezy three-minute dance of taps and swipes. Then you’ve got the old-timers like State Farm, which has built the mobile app that keeps them in the game. Insurance mobile apps are the real deal.

In this article, we’ll talk about why and how to develop a mobile insurance app.

Why Insurance Companies Need Mobile Apps

The insurance world is getting a big digital makeover, and mobile apps are the stars of the show. People’s expectations are shifting faster than a spring breeze, and if insurance companies want to keep up—let alone stand out—they’ve got to roll with it.

Here’s the deal: by 2025, mobile apps won’t just be a nice perk; they’ll be the bread and butter of staying in the game.

Changing Customer Expectations

People these days want everything at their fingertips, pronto. Checking a policy, sorting a claim, or just getting a quick answer—they expect it to be as easy as ordering takeout from their phone. Mobile apps step up with round-the-clock access, letting people handle their needs whenever and wherever—whether they’re on the couch or stuck in traffic. Miss this boat, and you’re watching the future zoom by.

Improved Engagement and Satisfaction

Mobile apps are like a friendly neighbor who’s always checking in—just without the small talk. Push notifications, custom offers, and updates that pop up right when you need them? That’s how you keep folks in the loop and feeling cared for. It’s no wonder loyalty and happiness shoot up. Take Lemonade, for instance—they’ve turned their app into a smooth ride that’s earned them a fan-club-worthy Net Promoter Score, rubbing shoulders with the big shots. A simple, friendly app can turn one-time customers into lifers.

Operational Advantages for Agents and Brokers

These apps aren’t just for the policyholders—they’re a lifeline for agents and brokers, too. Imagine being out and about, pulling up a client’s details in a snap, sorting claims, or tweaking policies right from your phone. No more desk-bound delays—just quick answers and happy clients.

Competitive Advantage

In a world where everyone’s vying for attention, standing out is gold. Companies pouring effort into mobile apps aren’t just keeping pace—they’re setting the bar. It’s a magnet for the tech-curious crowd and a billboard screaming “We’re modern!” Gartner’s number-crunchers say 53% of insurance bigwigs have already started investing in digital innovation.

Streamlined Processes

Think about the old rigmarole of claims and renewals—paper piles and phone tag. Mobile apps toss that out the window. Snap a photo, upload a doc, hit send—claims are done before your coffee cools. It’s faster for customers and cheaper for the company. Notably, AI in insurance can shave off 30% of the cost. It’s efficiency with a human touch.

Mobile apps tackle the cry for convenience, keep users engaged, smooth out the daily grind, and give you a leg up on the competition. Want to fins out the price of your future insurance mobile application, tap into our cost calculator. You just need to complete a quick multiple-choice quiz about you project.

Essential Insurance Mobile App Features in 2025

It’s 2025, and there you are, sprawled across your couch, a hot mug of coffee warming your hands. You’re sorting your insurance with a few sleepy swipes on your phone—no towering paper piles, no tinny hold tunes driving you up the wall, no urge to chuck the whole thing out the window. That’s the charm of a cracking insurance app. Get to know more mobile app development trends here.

Come along—we’ll show you the essential features of an insurance mobile app.

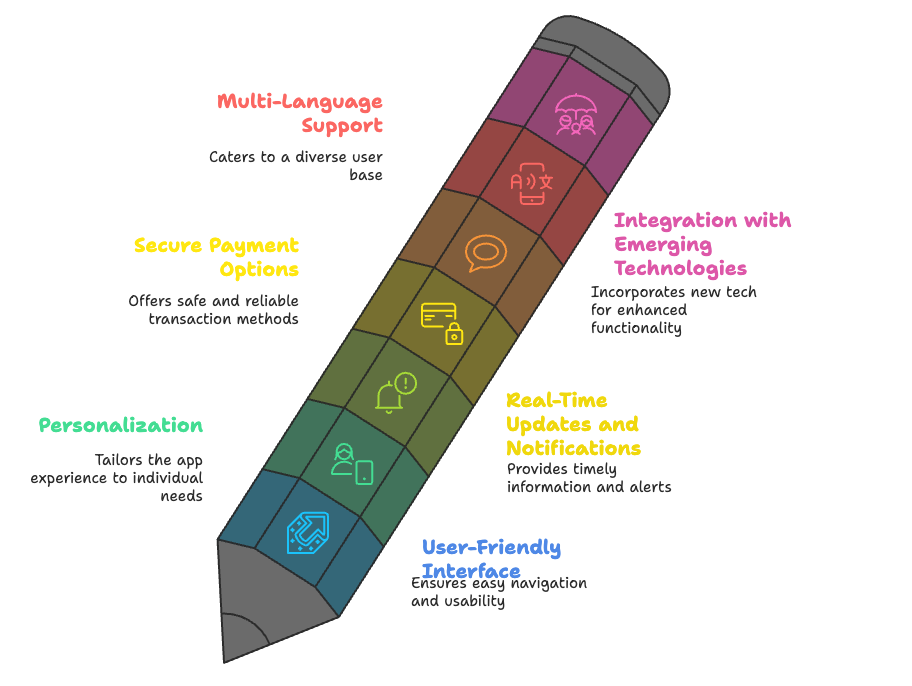

User-Friendly Interface

Now, picture yourself as a knackered mum or dad—one hand clutching your coffee, the other wrestling a wriggly toddler—and you’ve got to renew your health insurance before the clock runs out. Time’s slipping away, and the last thing you need is an app that’s like a puzzle box dipped in nonsense.

A proper user-friendly setup isn’t just handy—it’s your saving grace. It ought to feel like leafing through your favorite rag, with fat, friendly buttons and menus that don’t dodge about like shy kids at a party. Need to file a claim? Tap, tap, tap—sorted. Chuck in some voice technology, too, so anyone can play tech genius without breaking a sweat.

Personalization

Ever stroll into your local café and hear, “The usual, mate?” That little nod makes your day, doesn’t it? Now imagine your insurance mobile app doing the same. By 2025, the clever ones will peek at your life—new baby? Big trip?—and whip up policies that fit like a glove. No cookie-cutter nonsense here; it’s like having a savvy friend who’s always got your back, without the pricey bill. It’s not just data crunching—it’s a warm handshake in digital form. And trust us, customers notice when you care.

Real-Time Updates and Notifications

You know that gnawing worry when you’re waiting for news—any news? Let’s kick that to the curb. Picture this: Ping! “Claim’s in.” Ping! “We’re on it.” Ping! “You’re golden.” That’s real-time updates for you—little bursts of relief straight to your phone. Whether it’s a claim, a policy tweak, or a nudge to pay up, these apps keep you in the know. It’s not just handy; it’s a promise that says, “Hey, we’ve got you.” In 2025, that kind of trust is pure gold.

Secure Payment Options

Let’s talk money. These days, people want options—cards, bank transfers, maybe even a dash of crypto if they’re feeling futuristic. By 2025, your insurance mobile app had better deliver, or they’ll swipe left faster than you think. But here’s the kicker: it’s got to be safe. Iron-clad encryption, a double-check login—because nobody wants their cash vanishing into the ether. A survey says 69% of people love digital payments for speed, but only if they’re locked tight. Nail that, and you’ve got a winner—quick, easy, and worry-free.

Integration with Emerging Technologies

Now, don’t glaze over—this bit’s exciting. The future’s knocking, and it’s got gadgets galore:

- IoT and Wearables: Got a smartwatch? It could track your jogs and heartbeats, then nudge your health insurance to cheer you on with better rates. It’s like a pat on the back for staying fit.

- AI and Chatbots: In the Middle of the night, got a question? A chipper little bot’s there, guiding you like a night-owl pal—no coffee breaks required.

- Blockchain: Sounds fancy, but it’s simple—think of it as a diary nobody can scribble in. Your data stays yours, crystal clear and untouchable. That’s trust you can feel.

This isn’t tech for tech’s sake—it’s about making insurance smarter, friendlier, and downright human.

Multi-Language Support

Here’s a thought: the world’s a big, chatty place. By 2025, your app’s got to speak more than one tongue. A Spanish-speaking family hunting car insurance, a French traveler grabbing coverage on the go—give ‘em a warm “hola” or “bonjour” right on screen. It’s not just words; it’s a welcome mat for everyone. Make users feel at home, and they’ll stick around—simple as that.

Specialized Features for Different Insurance Types

Let’s face it: insurance isn’t one-size-fits-all, and neither should your mobile app be. By 2025, the smartest companies will tailor their apps to fit the quirks and needs of specific niches—health, car, travel, you name it. This isn’t just about slapping a logo on a generic platform; it’s about crafting tools that feel like they were made for you.

Here’s how insurance app development bends and twists to suit different types, proving its versatility while keeping customers—and big enterprise players—hooked.

Health Insurance Apps

Health insurance mobile apps don’t just store your policy—they bring the doctor to your screen with telemedicine, letting you chat with a pro without leaving the couch. Then there’s health tracking: sync your smartwatch, and it logs your steps or heart rate, nudging you toward wellness goals with a friendly wink. Some even toss in meditation tips or diet trackers. For medical insurance app development, it’s about turning a cold transaction into a warm lifeline, whether you’re a solo user or part of an enterprise app development for insurance rollout.

Car Insurance Apps

Now, imagine you’ve just scraped your bumper in a parking lot—ugh, the headache. But with a car insurance mobile app, it’s less of a nightmare. Snap a photo, tap “report accident,” and boom—your claim’s off and running. That’s the beauty of tailored car insurance app development. Roadside assistance? One button calls a tow truck faster than you can curse the flat tire. And here’s the kicker: usage-based insurance. Drive like a saint, and the app tracks it—fewer miles, safer habits, lower rates. The car insurance app development process weaves these into a sleek package, perfect for lone drivers or fleets under insurance enterprise app development. It’s not just an app; it’s a co-pilot.

Travel Insurance Apps

You’re halfway across the world, and your flight’s canceled—panic sets in. But a travel insurance app steps up like a trusty guide. Real-time alerts ping your phone: “Storm’s brewing, here’s the update.” Need help fast? Emergency assistance connects you to support with one tap—whether it’s a lost bag or a missed connection. Filing a claim? Snap a pic of the soggy suitcase, send it off, and relax. Travel insurance app development thrives on these moments, turning chaos into calm for jet-setters everywhere. It’s a pocket-sized safety net, scalable from solo travelers to corporate plans under enterprise app development for insurance.

The Insurance App Development Process

Building an insurance mobile app might sound like a tangle of tech jargon and endless headaches, but it doesn’t have to be. Strip away the mystery, and it’s a straightforward path from a spark of an idea to an app that customers can’t live without.

Let’s walk through the insurance app development process.

The Steps: From Vision to Victory

It starts with ideation—a good old-fashioned brainstorming session. What do your customers need? Maybe it’s instant claims or a wellness tracker. You dream it up, rough and raw.

Then comes design, where those ideas get a face—think sleek buttons and a layout that feels like home. To ensure you app is sleek and user-friendly, read our blog on mobile app design trends.

Next, development kicks in: the tech wizards weave their spells, turning sketches into a living, breathing app.

After that, testing—poking and prodding every corner to make sure it doesn’t crash when your customer’s filing a claim at 3 a.m.

Finally, deployment: the app hits phones, ready to shine. Five steps, simple as that, but each one’s a chance to get it right—or royally mess it up.

Why Experts Matter

The insurance app development process isn’t a solo gig—it thrives with pros who’ve been around the block. Experts don’t just slap code together; they know insurance inside out—claims quirks, compliance traps, customer gripes. They’ll spot pitfalls you didn’t even know existed and dodge them with insurance app development solutions that actually work. Partner with the best, like LITSLINK, and you’re not just building an app—you’re building trust, one tap at a time.

Scalable Solutions for the Big Leagues

Not every app’s for a single user thumbing through on a rainy day. Some need muscle—think enterprise app development for insurance, where entire companies rely on it. Picture a fleet of agents syncing policies in real time or a claims team handling thousands of cases without breaking a sweat. That’s where scalability comes in.

The right process doesn’t just churn out a one-off—it crafts a system that grows with you, from a small shop to a sprawling operation. It’s not about keeping up; it’s about staying ahead with solutions that flex as your business does.

Wrap-Up

We’ve walked through the world of insurance mobile apps—the sleek designs that make life easier, the personalized touches that feel like a friend, the real-time updates that banish worry, and the specialized features that fit every niche.

The insurance mobile apps keep customers happy, agents nimble, and your business sharp in a world that’s racing toward digital everything. The best insurance app development isn’t about keeping up—it’s about pulling ahead, turning convenience into loyalty and efficiency into profit.

So, where does that leave you? The future’s knocking, and it’s got a smartphone in hand. Insurance mobile app development isn’t some flashy gimmick—it’s a chance to meet your customers where they are right now and where they’ll be tomorrow. No hard sell here, just a nudge: think about it. A well-crafted app could be the edge that sets you apart, the quiet revolution that keeps you thriving in 2025 and beyond. Contact us if you have any questions!